Trésor-Economics No. 166 - Why is world trade so weak?

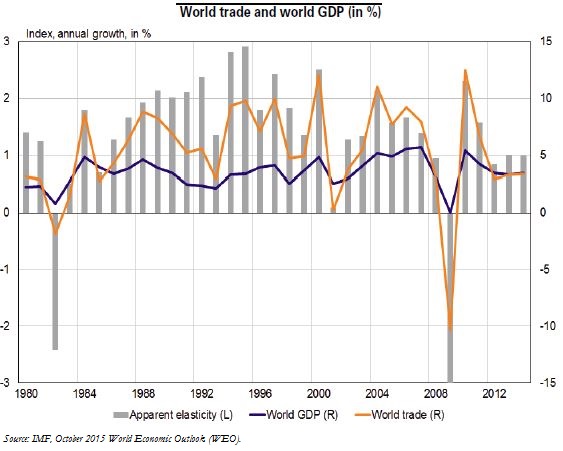

Since the 2008-2009 financial crisis, world trade in goods and services has been struggling to regain its pre-crisis momentum. World trade growth averaged only 3% or so a year between 2012 and 2015, versus 6.7% a year between 2000 and 2008–a decrease due to weaker global economic growth and a decline in trade intensity of economic activity.

Trade liberalisation and the increasing fragmentation of world production chains drove the vibrant growth in world trade until the mid-2000s. The 1990s and 2000s saw the increasing integration of China and countries of the former Soviet bloc into trade flows and the ramping up of free-trade agreements. These factors, together with technological progress, have promoted a growing fragmentation of production stages. This trend has gradually run out of steam.

Another factor affecting trade in recent years has been the composition of GDP growth. The share of investment and industry in the global economy is shrinking, while that of consumption and services–which are relatively less import-intensive–is rising. World trade flows are also influenced by the geographic composition of GDP growth: between 2011 and 2013, the European economy was particularly sluggish as a result of the euro area crisis. As it happens, the European economy is generally very trade-intensive, notably because of the substantial flows within the euro area.

In 2015, the slackness of world trade was accentuated by the contraction in emerging-country imports. The downturn exceeded what one might have expected from these countries' economic activity. The steep depreciations of many emerging currencies in 2015 drove up the cost of imports and curbed their volume in the short run.

By 2017, world trade growth should revive somewhat, but without regaining its pre-crisis buoyancy. World economic growth is forecast to remain moderate, and the elasticity of trade to GDP should increase again but stay close to unity. The above-mentioned structural factors fuelling the slowdown will likely continue to affect trade, while emerging-country imports should align more closely with their domestic demand. In the longer run, a moderate rebound in world trade is conceivable. However, a scenario where trade growth would lastingly outpace GDP growth seems rather improbable.