Trésor-Economics No. 155 - Actual and potential growth in China

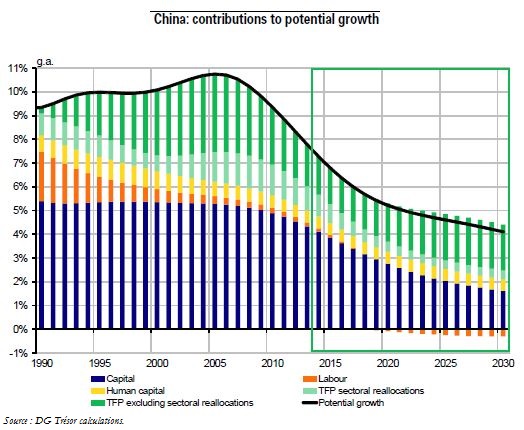

Before the crisis, China enjoyed a period of buoyant growth, driven mainly by capital accumulation. It was able to maintain a high investment-to-GDP ratio thanks to abundant savings, partly a consequence of distortions in factor prices including the exchange rate, wages and interest rates. Productivity gains also contributed to China's outstanding performance, through technological catch-up but also via sectoral reallocations of labour from agriculture to industry.

Since the 2008 financial crisis, however, China has been facing a sharp economic slowdown. The stimulus measures, which have led to a strong rise in investment, have admittedly offset the weakness of exports due to slacker external demand-but at the price of an aggravation of the economy's internal imbalances. Moreover, diminishing marginal returns on capital and an ever less efficient allocation of resources after the crisis have lowered productive efficiency and raised total debt, reflecting greater vulnerabilities. At the end of 2013, the authorities firmly committed themselves to rebalancing towards a more sustainable growth model.

In this current transition, the French Directorate General of the Treasury and the Banque de France have prepared an estimate of China's potential growth to 2030, in order to measure the impact of rebalancing on Chinese prospects. Using a production-function approach, the estimate incorporates-with adaptations-the latest conceptual developments that highlight the role of credit in determining potential growth; it also takes into account the impact on total factor productivity (TFP) of a shift in sectoral reallocations towards services.

On balance, our evidence suggests that the Chinese slowdown since the late 2000s is largely structural. GDP growth in 2014 was close to its potential, although with a mildly positive output gap. The downtrend in potential growth should persist, and may prove steeper in the medium term than the Consensus Forecast. Our findings point to the need for a fine calibration of fiscal policy, which could usefully accompany the structural transformations of the economy and the transition towards a more moderate and more sustainable growth model-while avoiding an excessive slowdown.