Trésor-Economics No. 148 - Value added tax in the European Union

VAT is France's highest-yielding tax. According to the national accounts, it generated €144bn in 2013. However, VAT as a share of GDP of total taxation is relatively small by comparison with the 27-member European Union (EU-27), whereas the ratio of total taxation to GDP in France is high (44.7% in 2013).

Furthermore, the VAT-to-GDP ratio has decreased since the 1970s in France.

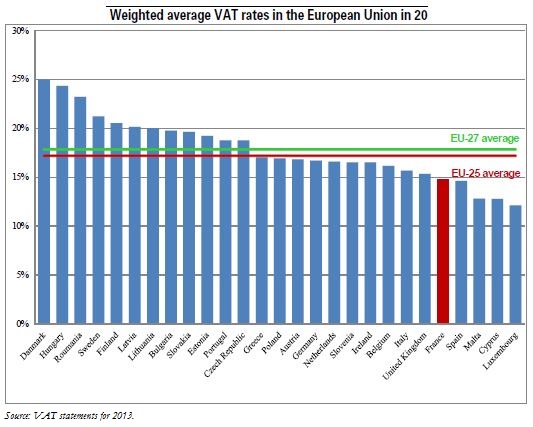

The comparatively modest share of VAT is mainly due to the fact that the weighted average VAT rate was lower in France (14.8%) than in the EU-27 (17.9%) in 2013, and not to differences in the VAT base. Due to EU legislation, the VAT base is now relatively harmonised in Europe, although differences persist. Only Malta, Luxembourg, Cyprus and Spain had a lower average rate than France in 2013, and the introduction of the intermediate rate (7% in 2012, raised to 10% in 2014) in France has not significantly altered the ranking.

The relatively low average VAT rate in France, which is 3.1 percentage points below the EU-27 average, is explained by the following factors:

- a lower than average standard rate accounts for 1.0 point: after the recent increases in the standard VAT rate in many Member States, only four countries had a lower standard VAT rate than France in 2014; five other countries had an identical standard rate of 20%, whereas France's rate was above the average in the 2000s;

- lower reduced rates account for 0.8 points: the weighted average reduced rate is 5.7% against an EU average of 7.9%;

- a larger scope of application of reduced rates accounts for 1.3 points: only 65% of the base was taxed at the standard rate in France versus an average 75% in the EU-27 in 2013.