Trésor-Economics No. 136 - Argentina, the vultures and the debt

Argentina's 2001 default on its sovereign debt was one of the largest in financial history. Its impact on orderly debt restructuring practices persists, particularly as a result of the dispute pitting Argentina against its "holdout" creditors, also known as "vulture funds".

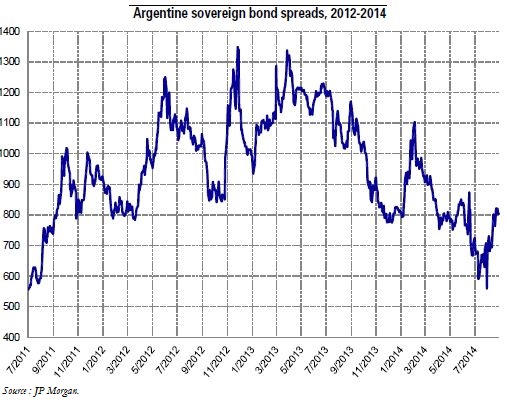

The "NML Capital v. Argentina" case has entered its final phase, as the Argentine government filed a petition with the Supreme Court of the United States in February 2014 to review earlier rulings in favour of the vulture funds. On 16 June 2014, the Supreme Court declined this request.

France has intervened in the case, filing a brief as a "friend of the court" (Amicus Curiae), alongside other countries (Brazil, Mexico and the United States, at an earlier stage of the proceedings), as well as economists and researchers. France's brief alerted the Supreme Court to the adverse impact that upholding the lower courts' decisions would have on the practice of orderly sovereign debt restructuring.

The crux of the dispute lies in the interpretation of a boilerplate clause in bond contracts called pari passu from the Latin for "on an equal footing". The legal meaning of this clause had never been called into question until vulture funds started suing defaulting countries in the late 1990s. The usual interpretation concerns seniority rankings of creditors in the eyes of the law, but vulture funds are now citing the language of this clause to demand "ratable" payment (which has a specific meaning in American courts) from Argentina each time it makes a repayment to the bondholders who exchanged their defaulted bonds for securities with discounted face values. In practical terms, this means that, if Argentina wishes to honour the payments owed to the exchange bondholders, it must also pay $1.33 billion to NML Capital.

There is more at stake in this case than Argentina and the pari passu clause alone. It could affect the future of sovereign debt restructuring, since participation of the greatest possible number of bondholders in exchange offers is critical for bringing excessive debts down to more sustainable levels.

Sovereign debt market stakeholders have started to discuss the most efficient ways to enhance the legal security of bond contract clauses and the capacity to implement restructuring deals, using such means as collective action clauses (CACs).