Trésor-Economics No. 127 - Gauging the impact of the french public seed-fund programme launched in 1999

Technology firms' creation requires specific financing tools to take into account the high level of risk associated with their activity. "Tech" start-ups could not significantly rely on bank funding and generally turn to sources such as the entrepreneur's family and friends ("love money"), business angels, or investors who have pooled their capital in funds run by management firms. Seed-funds represent the first stage of capital investment. They provide support to firms with high growth potential-often with a strong technological component.

In the late 1990s, France launched a public support programme for new technology firms to promote the development of a French seed-fund sector. In this issue of Trésor-Economics, we present the first public assessment of the 1999 seed-fund programme as of end-2011. This allows us to highlight some useful recommendations for current and future programmes.

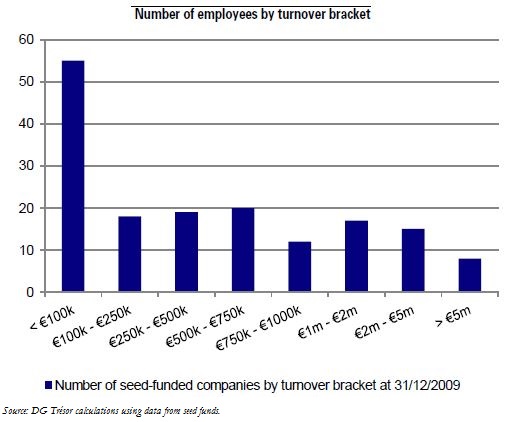

The programme has helped to build up the French seed-fund sector by setting up new management teams as well as seed funding dedicated units in the existing ones. By the end of 2011, the 204 seed-funded companies had created more than 1,700 jobs. Three of them had gone public, 31 had been sold to industrial firms and 13 had been sold to financial investors.

The excessively detailed specifications imposed on management teams have had a negative impact on the programme's financial return. However, the policy recommendations based on this first experience of public support have been taken into account for later government programmes such as FSI-France Investissement and the National Seed Fund (Fonds National d'Amorçage: FNA), which was set up as part of the "Invest for the Future" programme.