Trésor-Economics No. 123 - Emerging economies: heading for persistently slower growth than before the crisis

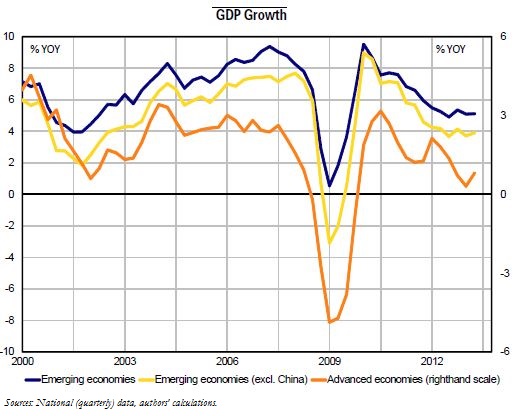

Economic activity in emerging economies has slowed significatly since 2011, after resisting fairly well to the financial crisis. Stimulus measures in 2009 enabled their activity to bounce back in 2010, but momentum began to flag in 2011. Growth was around 5.5% in 2011-2012, versus 7.5% in the period 2003-2007.

This slowdown is partly cyclical, due to a combination of domestic and external factors. Domestic demand has been particularly weak and the external environment has also deteriorated, with falling exports as a result of faltering demand in advanced economies. Structural factors have played their part in this slowdown as well. Emerging economies' potential growth is thought to have diminished due to a combination of demographic trends and changes in the capital stock, but also as a result of slower productivity gains as the catch-up process fades away.

Emerging economies have little margin to support activity in the short run. In a context of weak public finances, countries such as India, Brazil and South Africa, lack the means to support activity via a fiscal stimulus. Similarly, emerging countries appear to have used up most of their leeway with regard to monetary policy.

The emerging economies' growth models are now becoming less dependent on advanced economies. Whereas the share of exports to advanced economies had already been falling since the early-2000s, this trend has accelerated since the crisis. Moreover, due to declining exports, the crisis has increased the share of domestic demand in emerging economies' GDP.

While robust, growth in main emerging economies looks set to trend downwards, as their growth potential declines, especially in China. Emerging economies need to implement major reforms in order to support their potential growth. These reforms should focus on: i) rebalancing growth towards greater private consumption in China; ii) tackling structural investment deficits in other countries, which are hindering supply and thus penalising growth.