Trésor-Economics No. 93 - Learning from the first globalisation (1870-1914)

The current globalization, which began in the 1970s, is not unprecedented: between 1870 and 1914, the opening of national economies went hand in hand with a rapid expansion of trade and investment beyond national borders. The period also saw financial crises comparable to those of the late twentieth and early twenty-first centuries.

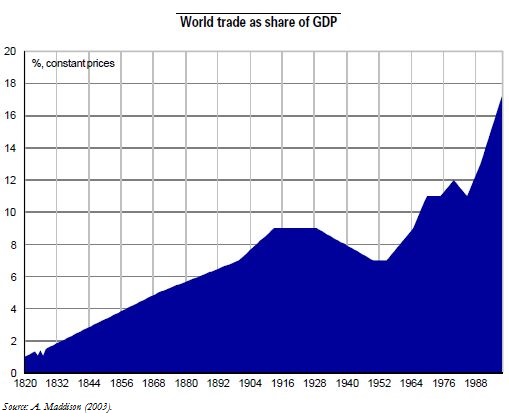

As for goods markets, the first globalization was characterized by a growth in trade (see chart), despite the adoption of protectionist measures in most advanced economies. Lessons have since been drawn from the lack of reciprocity and trade-policy coordination in the late nineteenth century, which had prematurely exposed certain developing economies to international trade. The establishment of international organizations now guarantees a gradual opening and closer trade-policy coordination for countries in different stages of development.

As for capital markets, the first globalization saw the growing financial integration of the advanced economies. This process was promoted by the exchange-rate stability made possible by the gold standard. Capital-flow recipients in both globalizations display common characteristics: investment goes to countries offering abundant natural resources, a skilled labour force, moderate transportation costs, and an institutional framework conducive to debt collection. In the first globalization, international capital flows were facilitated by the reduction in the exchange-rate risk and transaction costs due to the gold standard.

In the first globalization, the internationalization of financial markets and-to a lesser extent-the integration of the world's banking sector were accompanied by financial crises similar to those of today. This precedent underscores the advantages of having emerging-country debt denominated in local currencies and of current-account rebalancing: it reduces the vulnerability of national economies to sudden stops in capital flows.

Between 1870 and 1914, the opening of developed and less advanced economies was associated with swift growth in trade, investment, and financing beyond national borders. This period, described as the first globalization, displays similarities with the second globalization, which began in the 1970s. There are lessons to be drawn from the first globalization regarding trade policies and economic-policy measures capable of reducing vulnerability to financial crises.