Trésor-Economics No 88 - Implicit tax rate on corporate income in France

Corporate income tax (CIT) is usually seen as a tax levied at the statutory rate of 33.33%. However, assessment rules, reduced rates, tax smoothing procedures, and other variations in the tax base do require a more comprehensive study of other indicators to estimate the true tax burden on businesses. One of the most telling indicators, particularly for international comparisons, is the implicit tax rate (ITR), defined as the ratio of CIT revenues to the tax base measured by net operating surplus (NOS). This indicator differs from the 33.33% statutory tax rate for two broad categories of reasons:

– Rules for assessment of the tax base (particularly for loan-interest deductions) and for setting rates (reduced 15% rate applicable to a portion of profits of small and medium-sized enterprises [SMEs]) lower the ITR.

– Other factors, at the opposite, tend to raise the ITR. One is business demography, which involves events such as the death of certain units. Another consists of carry-back or carry-forward rules, which allow firms to deduct losses from past or future profits; these rules explain why some losses recognized in a given year may never entitle the firm to a future tax rebate.

For 2007, i.e., the year before the crisis, the ITR on non-financial firms in France reached 27.5%. With respect to the statutory rate, the assessment and rate rules lowered the ITR by eight points, while demographic factors raised it by two points.

Large firms (5,000+ employees: hereafter LFs) display a lower ITR than micro-enterprises (fewer than ten employees). The differences are traceable to three factors: (1) assessment rules: loan-interest deductions lower the ITR for micro-enterprises by three points but that of LFs by nearly fourteen points; (2) rate-setting rules: the reduced rate for SMEs lowers the ITR for micro-enterprises by more than eleven points, but the annual flat tax (imposition forfaitaire annuelle: IFA), to be withdrawn in 2014, raises it by more than three points; (3) higher risk of death among the smallest enterprises: because of this demographic factor, the average ITR for micro-enterprises exceeds the rate that would apply to consistently profit-making micro-enterprises.

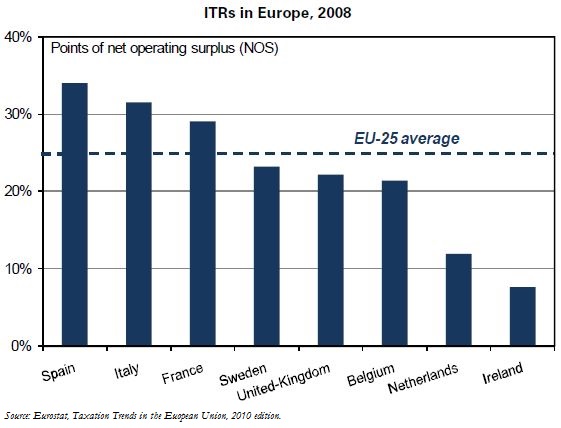

As for 2008, European comparisons suggest, France ranked above the average for the European Union (EU-25) in 2008, but below countries such as Spain or Italy. In nominal terms, the only country to post a higher rate than France was Malta.