Trésor-Economics No. 87 - Emerging countries' foreign exchange reserves and accumulation strategies

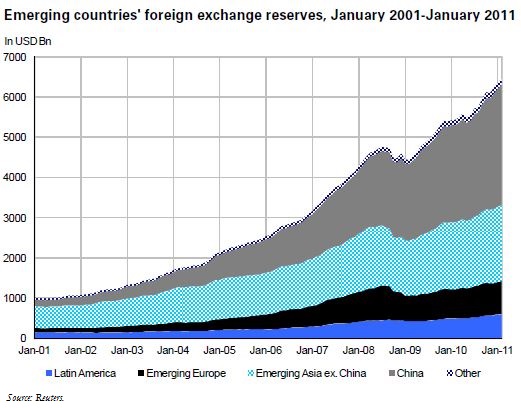

The emerging countries' net foreign assets have been expanding faster than those of the developed countries, since 2004, thanks to larger trade surpluses and capital inflows than previously. Today they represent two thirds of world foreign exchange reserves. China and the other emerging Asian economies, with fairly rigid exchange regimes, hold the bulk of these reserves.

These reserves have enabled the countries that have accumulated them to withstand the crisis rather better than the developed countries. This protective effect probably stems more from the confidence born of holding large reserves than from their actual use.

Capital flows to the emerging countries dropped by more than USD 1,000 billion during the crisis. Some countries were relatively less affected. If all countries had been affected as much as those hardest-hit, this drop would have been twice as large. The emerging countries may consider to protecting themselves against this risk. With the return of capital flows to these countries in spring 2009, the accumulation of currency reserves resumed, including in countries with sufficient reserves during the crisis.

However, the accumulation of "excessive" currency reserves can be costly, collectively, when the price for this is durably undervalued exchange rates, helping to sustain global imbalances. But it comes at a cost to individual emerging countries as well. This accumulation can be limited in a variety of ways, namely: (i) improved financial safety nets, (ii) better regulation of capital flows to curb their instability, and (iii) more flexible exchange rates in a greater number of emerging countries.

If the emerging countries were to go on rapidly accumulating reserves, they would probably seek higher returns, which could lead to a diversification of reserves with a heavier emphasis on riskier assets such as equities and corporate bonds, or assets denominated in other currencies (yen, euro, yuan or real, for example).