Trésor-Economics No. 80 - Toward a more balanced world growth: the possible contributions of the United States, China, Germany and Japan

From a macroeconomic standpoint, the 2000s witnessed a significant rise in global imbalances. Between 1998 and 2007, the total of G20 current account deficits and surpluses rose by nearly two trillion dollars. These imbalances have contributed to the seriousness of the economic crisis.

At the September 2009 Pittsburgh Summit, the G20 heads of state decided to create a "Framework for Strong, Sustainable and Balanced Growth" in order to coordinate reforms aimed at rebalancing world growth.

We focus here on the three main current account surplus countries (China, Germany and Japan), and identify a handful of reforms that could foster a more balanced growth. These include greater social protection in China, as well as the development of financial markets, with an accompanying revaluation of the yuan at a pace comparable to that observed between 2005 and 2008; and increased competition in the service sector in Germany and Japan.

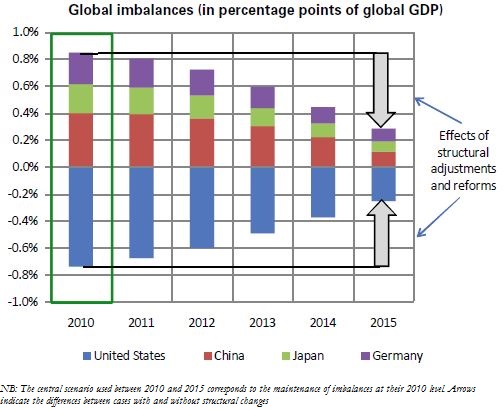

A study based on an international macroeconomic model shows that these reforms, along with a slight structural rise in the US savings rate, would yield a significant reduction in current account imbalances, with the potential to halve them in 5 years (see chart below).

Increased activity in countries that implement reforms to stimulate their domestic demand would more than offset the shortfall in global growth resulting from lower consumption in the United States; global economic activity would be 1% higher after 5 years, with a sizeable surge in global trade. These results point to the relevance and realistic nature of the G20's "Framework for Strong, Sustainable and Balanced Growth".

This paper does not analyse the impact of fiscal consolidation measures in the advanced economies and of potential structural reforms in the current account deficit countries (in particular those aimed at improving financial regulation and stimulating competitiveness), even though they too are essential to achieving strong, sustainable and balanced growth.