Trésor-Economics No. 64 - How vulnerable are the emerging and developing countries to a drop in migrants' remittances?

Emerging countries' payments balances have come under severe pressure since the onset of the crisis in Autumn 2008, as widespread deleveraging has led to massive capital outflows from these countries. In earlier crises affecting the emerging countries migrants' remittances proved resilient, acting as a stable source of financing. This appears to have been less the case in the present crisis, however, the migrants' host countries having equally been affected by the crisis.

Falling migrants' remittances have dented the macro financial position of the countries concerned, especially given that these were a prime source of financing during the previous growth cycle (especially in cyclical sectors such as property, etc). The adverse impact on activity has also impacted other sources of hard currency, leading to a rise in these countries' borrowing requirements.

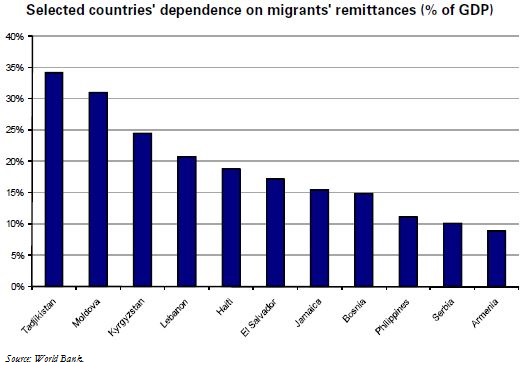

The emerging countries that are a priori most vulnerable to a reduction in transfers share a number of characteristics: they are small, their current accounts are heavily dependent on incoming remittances, and they are linked to a source country whose macro financial situation and/or where the situation of migrants is deteriorating. This concerns the CIS countries, Central America and the Caribbean, and certain Eastern European countries such as Romania, and Asia (e.g. the Indian subcontinent and the Philippines).

Some of these countries already appear to be suffering badly in the first quarter of 2009. The worst affected countries were those of the CIS, where the year-on-year drop in remittances amounts to 30%. The reduction comes to around 10% over the year in Central America and the Caribbean for the first quarter, but the decline is accelerating. The Asian countries, particularly Pakistan, Bangladesh and the Philippines, on the other hand, have been spared for the time being and transfers are proving resilient.