Trésor-Economics No. 50 - The economic impact of the 2008 research tax credit reform (Crédit d'Impôt Recherche)

In so-called knowledge-based economies, both research and development (R&D) and innovation are essential to growth and competitiveness. In this respect, France does not appear to be investing enough in R&D activity. With R&D spending at 2.1% of GDP, France ranks in the middle of the league table, above the European average but well below Germany, the Scandinavian countries, the United States and Japan.

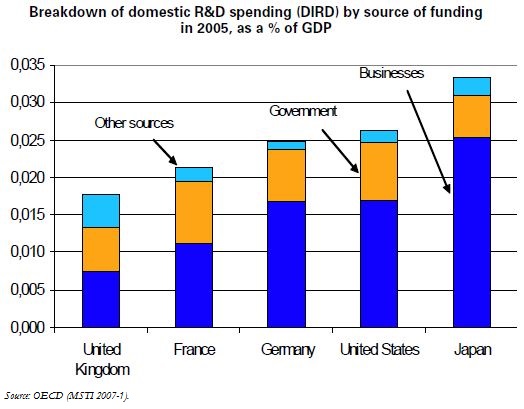

The gap between France and its main partners in terms of R&D intensity can be entirely attributed to the volume of private-sector R&D. Although France ranks among the leading countries in terms of publicly-funded R&D, private-sector domestic R&D spending (DIRDE) amounts to only 1.1% of GDP, versus 1.7% in Germany and the United States, and 2.5% in Japan.

France has taken steps to address this situation by seeking to stimulate private sector investment in R&D. In particular, the 2008 Budget Bill reformed the research tax credit (CIR - Crédit Impôt Recherche).

The previous CIR was based on a mixed system that proved to be too complex without providing sufficient incentives. The 2008 reform of the CIR seeks to boost the mechanism's effectiveness in two ways: first by discarding the tax break applied to increased R&D spending by companies, and second by increasing the CIR applied to the level of R&D spending.

This reform constitutes a significant effort to boost private sector R&D, with public support rising from €1.6 billion for R&D spending in 2007 to €4.1 billion in 2008. As a result, the intensity of R&D spending is expected to rise by 0.33 percentage point of GDP over the next 10 years, and it is estimated that companies will require 25,000 researchers between now and 2022 (or 25% of the current total).

The reform is expected to have a major impact, adding 0.6 percentage point to GDP at the end of 15 years, or nearly 0.05% of GDP on average per year over 15 years. This means that each euro spent by the government in the form of the research tax credit should add €4.50 to GDP.