Trésor-Economics No. 39 - The outlook for pension spending and the role of a reserve fund

Thanks to the abundant baby boom generations, for the past several decades demographics have been highly favourable to pensions funding. This benign situation is coming to an end as these generations reach retirement. Much of the attendant increase in pension spending is set to last, thanks notably to the durable rise in life expectancy.

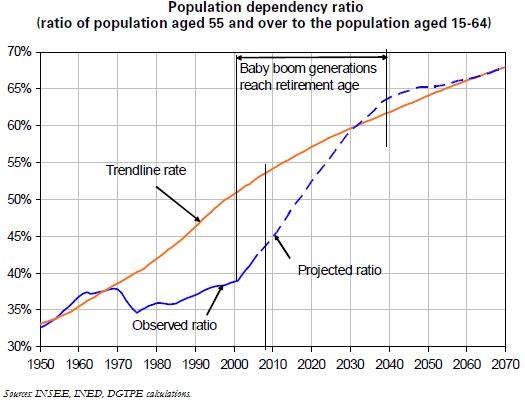

This is because the baby boom initially increased the proportion of children in the French population, and then, from the 1970s onwards, that of people of working age able to contribute. The increasing generosity of the French pension system was based on this highly propitious demographic situation. However, these favourable demographics partially hid the underlying ageing of the population and began to dwindle starting in 2006, as the first baby boomers took retirement. It will fade completely after 2030. After that date, the baby boom will no longer have any impact on the population's age structure, which will revert to its long-term trend.

To smooth the temporary baby boom shock, a reserve fund ought to have been put in place starting in the 1970s, in order to build up surpluses during the entire period of favourable demographics. Instead, the system became increasingly generous, in proportions well above the leeway provided by the demographic situation, leading to the emergence of deficits. Consequently, even if it is unable to smooth the baby boom shock, the Fonds de Réserve pour les Retraites (FRR or Pension Reserve Fund) put in place in 2000 can help to smooth the rise in spending as these more abundant generations reach retirement (i.e. smooth the necessary adjustments); alternatively, it could serve as a long-term fund to finance pensions, or it could cushion the shock brought about by the temporary drop in the birth rate at the end of the 20th century.