Trésor-Economics No. 38 - Should structural reforms be coordinated in the euro area?

Within the framework of the Lisbon strategy, the European Union member states have committed to undertaking major structural reforms between 2000 and 2010. The reforms were intended to stimulate supply and demand and therefore deliver large gains in terms of activity in the reforming country.

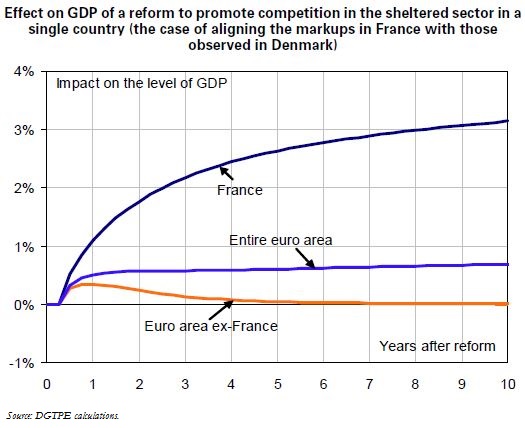

In a monetary union like EMU, structural reforms by one member state affect the economy of other member states through changes in relative competitiveness and the reaction of the common monetary policy.

Structural reforms to increase competition in goods and services markets have positive effects on economic activity, consumption and purchasing power in the reforming country. Reforms in the nontradable goods et services sector also have a short-term positive effect in the other countries in the monetary area. On the other hand, reforms in the sector exposed to international competition can have substantial short-term negative externalities, which are all the greater if the reforming country is a large one. Accordingly, gains would arise from coordinating the reforms of the exposed sectors within the EMU.

Greater labor market flexibility would have positive effects on economic activity, the volume of hours worked and total earned income, despite a decline in real wages per hour worked. Simultaneous reform across the entire euro area would limit the negative impact on hourly wages, without however eliminating it completely in the short term.

A positive solution for economic activity and purchasing power could involve synchronized implementation throughout the euro area of reforms in the labor market and in the sector sheltered from international competition.