Tresor-Economics No. 33 - The carry trade and recent yen movements

The existence of a strong Japanese current account surplus against a background of relative yen weakness in recent years raises questions, and is contributing to the persistence of international balance of payments imbalances.

Over and beyond the role played by macroeconomic policy in Japan (with very low key rates especially), a decline in Japanese households' preference for domestic securities (known as the "home bias") is one suggested explanation for the yen's weakness: they are thought to be buying greater quantities of foreign securities to rebalance their portfolios, previously overweight in Japanese assets. However, a closer look at the securities held by Japanese households does not bear out this hypothesis.

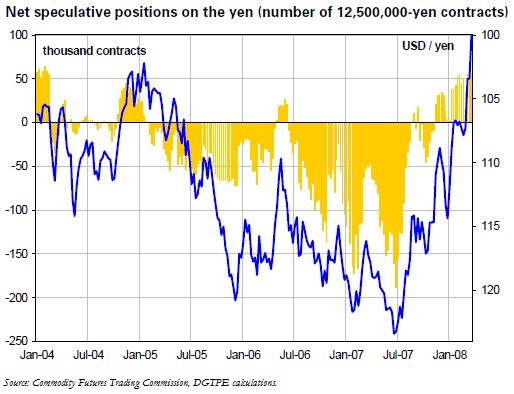

We show here that the weakness of the yen until summer 2007 was partly due to speculative "carry trades" on the foreign exchange markets. It is hard to identify these trades–notably involving derivatives swaps–clearly. In addition, they may induce instability since they could potentially destabilise the financing of certain economies in the event of a shift in market operators' expectations.

Indeed, periods of stronger market volatility have witnessed a rapid appreciation of the yen accompanied by a depreciation of other currencies (Iceland, Australia, United Kingdom, South Africa, etc.). From an estimation of an optimal portfolio, it is possible to determine which currencies are liable to experience sharp corrections.