Trésor-Economics No. 29 - Implementation of the Markets in Financial Instruments Directive: what is at stake?

The Markets in Financial Instruments Directive (the MiFID) came into force on 1 November 2007. Under this directive, States can no longer require investors' orders to be concentrated on the regulated exchanges only. As a result of this rule, applied with variable rigour from one European country to another, the great majority of orders have hitherto been routed through regulated markets, and in particular Euronext Paris in the case of equities eligible for trading on the French stock exchange.

In future, order flows will be broken up de facto, given that investors' orders can now be executed on either regulated markets or new electronic systems (multilateral trading facilities-MTFs), or through a financial intermediary. The latter will serve as counterparty to the transaction by playing the role of systematic internaliser, like the market makers on the LSE and Nasdaq, except that they operate outside a regulated market or a MTF. It is reckoned that in France more than 10% of CAC 40 equity trading volumes were already being traded outside the Euronext trading system at the time the directive came into force, and could therefore very rapidly be diverted towards these alternative trading platforms.

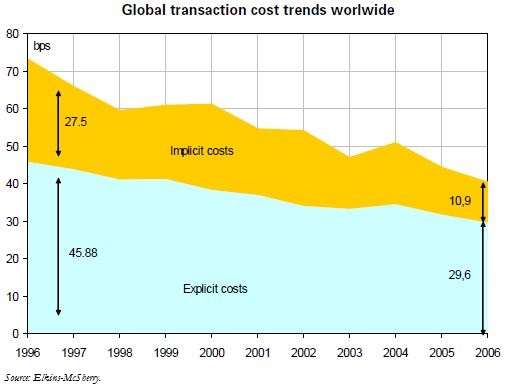

The spread of competition between trading centres to Europe as a whole is part of a process going back to the 1970s, one major consequence being lower transaction costs. The stakes are significant, since the hoped-for fall in transactions costs will have a direct impact on the cost of capital-on the order of 10% according to some experts. This in turn will ultimately support economic growth by encouraging investment.

The fragmentation of order flows could equally well squeeze market liquidity, which could raise costs, on the contrary. However, past observation suggests this second effect is of lesser importance. The impact remains difficult to assess, since it will probably differ depending on the type of investor or the security's liquidity.