Trésor-Economics No. 28 - The conditions for a positive contribution of sovereign wealth funds to the world economy

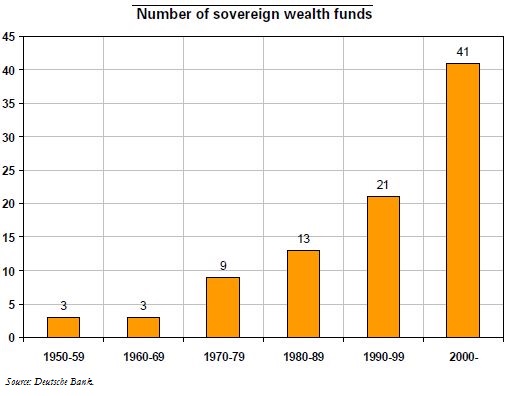

The so-called Sovereign Wealth Funds (SWFs), set up by governments enjoying fast growing external revenues in order to manage sovereign wealth separately from official foreign reserves, are already surpassing the hedge fund industry in terms of assets under management. Their aggregate asset portfolio is still much lower than total assets under private management (2 to 3 trillion $ versus 53 trillion $) but, on current growth trends, it would exceed 10 trillion $ in the next few years.

Traditionally, foreign reserves have been largely parked in passive investments, mostly in US Treasury bills and bonds, with central banks focusing on security and liquidity. Rising SWFs invest in a broader range of assets with the aim to raise the return of their portfolio. By increasing their holdings of risky assets, they would raise the demand for equities, emerging market assets and risky assets in general.

Most of them have low levels of transparency, which might undermine financial market stability by exacerbating the volatility of some asset prices and prevent market participants from anticipating correctly relative asset price changes. Furthermore, their opacity, combined with their public ownership, spur concerns that they may actually operate to serve strategic interests.

Nevertheless, sovereign wealth funds may contribute to stabilize the international financial system, provided that their management transparency is improved. From a technical standpoint, some solutions may be found: identifying best practices for index-driven management, investment rules or public accounting. A more ambitious objective would be to tackle the issue at its roots by moving away from the "non-cooperative equilibrium" of excess reserve accumulation, by aiming to reduce global current account imbalances and better insuring emerging countries against international financial risks.