Trésor-Economics No. 25 - The impact of the housing slowdown on US consumption

Household consumption has been one of the main drivers of growth in the United States since 2002. However, a number of factors could drag down US consumption looking to 2008, the housing slowdown among them.

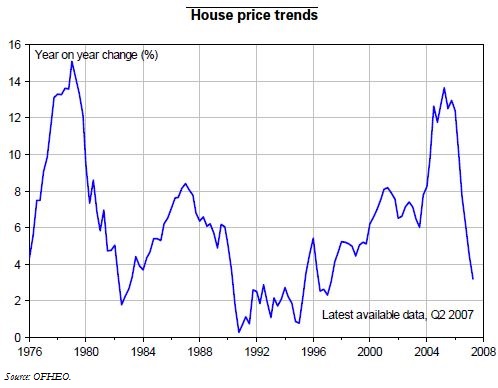

The housing market has been showing signs of weakness since the end of 2005, but it has been slowing more sharply since mid-2006. Prices are expected to continue levelling off in the coming quarters and to weigh on consumption via two channels, namely the impact of declining household wealth, and the effects of the drying up of mortgage equity withdrawal (MEW).

The first channel is the traditional one: when the price of households' housing assets falls, their housing wealth declines, all other things being equal; consequently, their permanent income is revised downwards leading to a slowdown in their consumption. A 5% slowdown in house prices would slow consumption by 0.7% in the short term, and by 0.3% in the long run.

The second channel, MEW, allows American homeowners to raise cash when house prices are rising. This cash is reckoned to be a major factor sustaining consumption since 2002. Conversely, the housing downturn would lead to a drop in MEW, thereby potentially depressing consumption. The amounts withdrawn by this means has fallen from USD 700 billion in the first quarter of 2006 to USD 360 billion in the second quarter of 2007.

Actually, MEW appears to have only a limited impact on consumption: in a 5% annual house price slowdown scenario, annual MEW would decline by USD 130 billion (1% of GDP), which would reduce consumption by 0.1% only. This relatively small effect could be accounted for by the depth and liquidity of the US credit markets, which allows households to substitute other forms of financing for MEW.