Trésor-Economics No. 16 - Do financial variables yield greater insight into the economic situation in real time?

There are several methods for dating past economic cycles, but it is harder to define where we are in the cycle in real time. The difficulty in detecting turning points sufficiently quickly can give rise to substantial forecasting errors, generally common to the entire forecasting community.

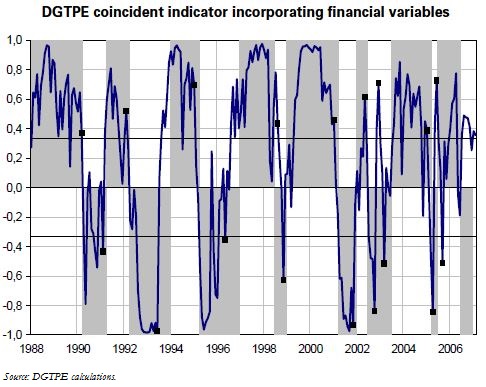

The practice, in that case, consists in consulting business tendency surveys and, in the past ten years or so, qualitative indicators known as "turning point indicators". Even so, these failed to alert forecasters sufficiently early in 2002, when the shock to the financial markets sparked by the Enron affair prompted a wave of mistrust and hesitancy on the part of economic agents and finally aborted the fledgling recovery.

According to economic theory there is a link between financial markets and business activity. That is because markets determine agents' financing terms and their wealth, while asset prices reflect agents' expectations as to the level of economic activity. However, this link appears to be very loose as soon as one tries to validate it empirically in Europe.

Here we seek to utilise this theoretical link in a purely qualitative fashion by enriching the customary indicators of turning points with financial variables. The result fails to match either what theory suggests or the intuitive view that the shocks to which our economy is subjected are increasingly financial in nature. Admittedly, the indicators "enriched" by financial variables are better at capturing growth rates, but the improvement is marginal and the dates of the turning points are barely captured more accurately. In particular, they would not have avoided the mistake made in 2002.

These findings do not invalidate the link between financial markets and the real economy, but they do suggest that businesses' replies to the surveys already include a large portion of the relevant financial data.