Trésor-Economics No. 13 - Examining the impact of Basel II on the supply of credit to SMEs

To safeguard against credit risk and prevent a systemic crisis, banks must comply with prudential regulations requiring them to hold a certain amount of capital for each loan granted. The Basel II Capital Accord has reformed the procedures for calculating regulatory capital - which now increases with borrower risk - as part of efforts to strengthen the stability of the international banking system. Basel II was implemented in Europe through Directive 2006/49/EC, which is currently being transposed in France.

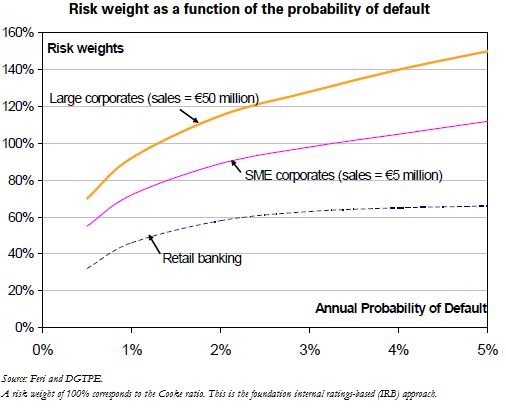

Basel II is designed to ensure that small and medium-sized enterprises (SMEs), which are theoretically riskier than big firms, are not hindered from accessing credit. Given the same probability of default (PD) and loss given default (LGD), bank loans to SMEs are subject to lower capital requirements than claims on larger firms (cf. chart). SME risk is highly idiosyncratic (linked to industry, local and human specific factors that banks can diversify by pooling a large number of claims on SMEs in their loan portfolios. The capital requirement for SME claims is estimated to be some 30% lower compared with Basel I.

However, regulatory capital varies significantly with credit risk. This should encourage banks to price in closer accordance with company risk - something they do to a relatively small extent in France today. The observed dispersion of loan pricing is indeed far lower than the level that would have been expected if banks were lending to riskier-than-average firms and passing on the cost of risk in their margin.

By fostering a more risk-sensitive approach to bank’s pricing, Basel II could bring pricing more in line with costs, ultimately improving the supply of credit to SMEs.