Trésor-Economics No. 10 - Distinguishing cyclical from structural components in French unemployment

The French unemployment rate fall to 8.6% at the end of 2006, its lowest level since 1983. For the year as a whole, unemployment has declined by around 1 percentage point: can we put this fall entirely down to a good economic situation, or does it also reflect structural improvements in the labour market?

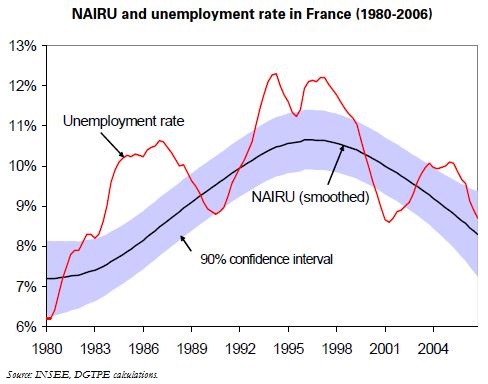

To answer this question we need to distinguish between cyclical and structural components in the actual unemployment rate. One fairly common approach is to look simultaneously at fluctuations in unemployment, inflation, expected inflation and energy prices. In this approach, based on the "expectations-augmented Phillips curve", a fall in unemployment that is not accompanied by an unexpected rise in inflation (excluding any energy price effects) is interpreted as a fall in the structural component of unemployment (the non-accelerating inflation rate of unemployment, or the NAIRU), whereas a fall in unemployment accompanied by an unexpected rise in inflation is interpreted as a fall in the cyclical component of unemployment.

Starting from this idea, using relatively simple statistical methods, we can calculate that the NAIRU for the fourth quarter of 2006 was around 81/4% (with a hefty margin of uncertainty). Above all we can calculate by this means that it has fallen each year by around a third of a percentage point since 2000. It is further calculated that cyclical unemployment is currently low, thus limiting the effectiveness of demand policies in reducing unemployment and suggesting that further improvement will stem primarily from structural economic reforms.