Trésor-Economics No. 7 - Firms’ access to bank credit

Firms may be denied access to bank loans even if they are willing to pay high interest. This phenomenon - known as "credit rationing" - remains hard to quantify, as credit supply and demand are not directly observable. However, some evidence suggests that credit rationing has been significant in France during the 1990s.

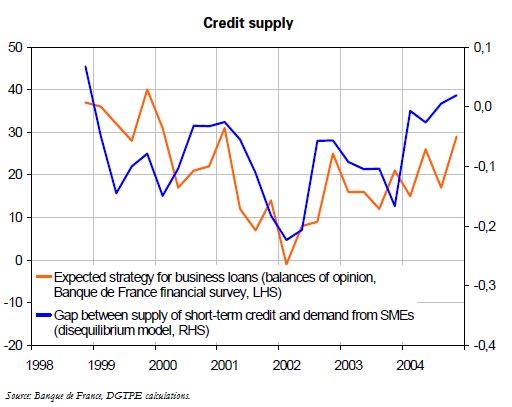

A disequilibrium model estimated on French data for the recent period suggests that banks failed to satisfy a large share of demand from small and medium-sized enterprises (SMEs) for short-term credit (crédits de trésorerie, a form of cash advance) in 2001. This situation - apparently confirmed by the Banque de France financial survey - seemed to be partly due to credit rationing, which restricted the ability of SMEs to finance economically viable projects.

To limit the risk of credit rationing, the French State takes on a share of the credit risk via a guarantee scheme set up by Oséo / Sofaris. The State needs to charge banks for the guarantee at a high enough price for banks to confine its use to categories of risky firms vulnerable to rationing. The State raised its price in 2004 in order to target the incentive more effectively and restrict the windfall gain for banks.

These developments - as well as the implementation of new capital adequacy standards (Basel II) - should also incite the banking sector to practice greater risk-based discrimination and lead to a better-adapted pricing of credit.