Coordinating Fragmented Creditors to Restructure Sovereign Debt: the Case of Sri Lanka

Following Sri Lanka’s default on its external debt in April 2022, official bilateral creditors developed an original coordination mechanism to restructure the country’s debt. France, India and Japan co-chaired an ad-hoc Official Creditor Committee including the Paris Club, India and Hungary. At the same time, a flexible coordination arrangement with China and regular discussions with private creditors secured a debt treatment compliant with IMF programme targets and comparability of treatment.

On 12 April 2022, with an already precarious debt situation exacerbated by the COVID-19 pandemic, Sri Lanka announced that it was defaulting on its external debt. The deterioration in the country’s economic situation led Sri Lanka to negotiate an agreement with the IMF for a $2.9-billion Extended Fund Facility for the 2023-2027 period to support a reform programme.

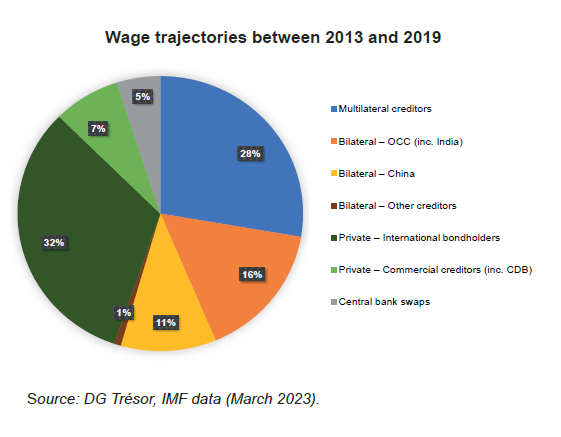

In the wake of the COVID-19 pandemic, the G20 and the Paris Club adopted a Common Framework to coordinate debt restructuring for low-income countries, but Sri Lanka – a middle-income country when it defaulted – did not qualify. Nevertheless, the Common Framework’s coordination channels served to set up an ad-hoc Official Creditor Committee (OCC) co-chaired by France, India and Japan and including Paris Club creditors, India and Hungary, which accounted for 16% of the external debt stock. At the same time, a “flexible” coordination arrangement was put in place with China, which held 11% of Sri Lanka’s external debt stock.

The bondholders, accounting for 32% of the foreign creditors, restructured their securities by introducing an innovative financial instrument indexed to Sri Lanka’s GDP growth called macro-linked bonds. This contingent debt treatment complicated the official creditors’ assessment of effective terms of treatment from the private creditors at least equal to those of the official creditors (“comparability of treatment”).

Sri Lanka’s experience demonstrates the possibility of coordination with China outside of the Common Framework in order to proceed in parallel with debt treatment and prevent delays with the IMF-supported programme. Timely and regular discussions with bondholders also served to rapidly reach an agreement on debt treatments compliant with both IMF programme targets and the principle of comparability of treatment.