The Distribution of Income Generated in France Between Labour and Capital

In France, the share of labour-related expenditure in the value added of non-financial corporations has been relatively stable since 1990, as has that of net wages. This stability masks changes that occurred in phases and which were connected, inter alia, with economic shocks and tax reform. The capital share has also been stable with an increase in dividends being offset by a fall in interest paid out.

Generally speaking, the income generated in a country is divided between labour (labour costs, meaning all expenditure connected with using the labour factor), capital (gross operating surplus) and, residually, general government (taxes on production and operating subsidies).

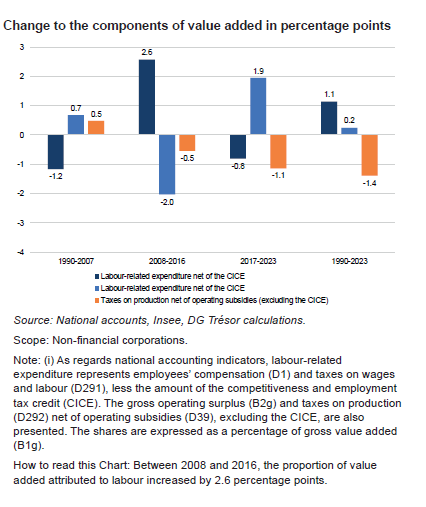

For the past three decades in France the proportion of labour-related expenditure in the value added of non-financial corporations has remained fairly stable at around two thirds. Between 1990 and 2023, changes to this share can be broken down into three separate phases (see Chart). It fell between 1990 and 2007 as businesses offset rising taxes on production by limiting wages and recruitment. It then increased between 2007 and 2017 as the shock to business activity caused by the financial crisis had a greater impact on companies’ gross operating surplus than on the payroll which is less flexible. From 2017 to 2023, it declined slightly essentially due to the time-lag in wages aligning with the 2022 inflationary shock, an adjustment which continued into 2024. In addition, the cut in taxes on production over the period allowed for an increase in gross operating surpluses.

The slight rise in the proportion of labour-related expenditure in value added between 1990 and 2023 mirrors that of labour-related levies whereas the share relating to net wages (before income tax) remained stable.

Within the capital share, net dividends increased between 1990 and 2023 whilst net interest paid out fell. The corporate savings rate and businesses’ ability to self-finance their investments rose slightly.