How Strong Were the Finances of DTIB Companies Before the War in Ukraine?

Before the war in Ukraine, companies in the defence technological and industrial base had a weaker financial and economic position than companies in the rest of the economy, including thinner margins and higher debt levels. Since 2021, however, larger European defence budgets have improved the growth outlook and financial health of these companies, while also increasing their investment needs.

At a time of increasing international tension, the economic and financial position of companies “that help to design and produce equipment for armed forces” (i.e. the “defence technological and industrial base” or DTIB) is a major concern, particularly as regards small- and medium-sized enterprises.

To analyse the economic and financial position of these companies, France’s Economic Observatory for Defence and the Directorate General of the Treasury carried out a study covering the period from 2016 to 2021, looking at a sample of 2,072 companies (intermediate-sized, medium-sized and small enterprises) operating in sectors most closely associated with the DTIB.

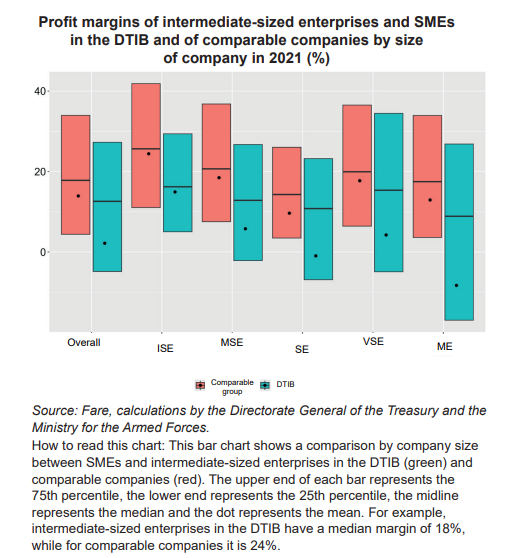

During that period, DTIB companies (excluding large corporations and micro-enterprises) had a weaker financial and economic position than companies in the rest of the economy: they had thinner margins, were less able to create value, had higher debt levels and were potentially undercapitalised.

DTIB companies’ ability to repay debts was lower than that of comparable companies in the rest of the economy, but they had higher debt levels, suggesting that they had sufficient access to bank credit.

They made greater use of external funding in their equity capital formation, partly because they were less able to generate profits capable of strengthening their equity base.

However, since 2021, the increase in European defence budgets in response to the war in Ukraine, along with several public-sector initiatives – such as the creation of the European Defence Fund and the loosening of the European Investment Bank’s funding rules – have improved their growth outlook and therefore their financial health, although increased demand is also leading to increased funding needs.