Implementation of Monetary Policy in the Euro Area and the United States

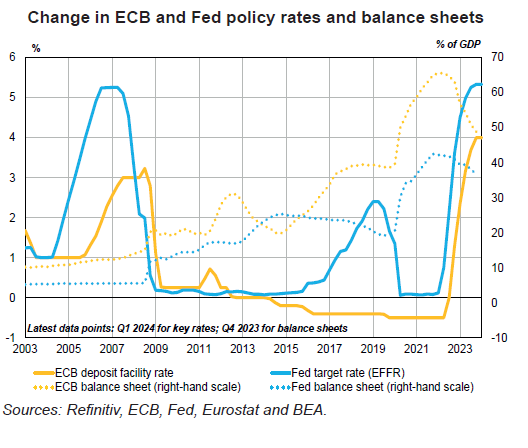

The monetary policies of the Fed and the ECB have both been subject to significant changes since the 2008 financial crisis. The two central banks have had to adapt to recurring shocks (including, most recently, the COVID-19 pandemic and the inflation shock) by changing their instruments with a view to fulfilling their respective mandates. Following a period of low rates and ballooning balance sheets, the Fed and the ECB embarked on wide-reaching monetary tightening as from mid-2022.

Monetary policy refers to the decisions made by a central bank to influence the cost and supply of money in a given economy. The primary mandate of the European Central Bank (ECB) is to maintain price stability while the United States Federal Reserve’s (the Fed) dual mandate is to ensure stable prices and maximum employment. On the price stability front, both of these central banks have set a 2% inflation target over the medium term.

Policy rates are generally the main instrument used by central banks to carry out their mandate. Policy rates are interest rates applied by central banks to the loans they grant to commercial banks and to the deposits they receive. These rates have an impact on the real economy in a myriad of ways: interest rates, asset prices and the exchange rate.

For the past fifteen or so years, the Fed and the ECB have adjusted the way their monetary policy is implemented to cope with various crises: the 2008 financial crisis, the 2010 European sovereign debt crisis, the COVID-19 pandemic in 2020 and, most recently, an inflation shock in 2021 exacerbated by Russia’s invasion of Ukraine in 2022.

In order to handle the fallout from these crises and circumvent the zero lower bound, the ECB and the Fed have adopted a range of new “unconventional” instruments, such as asset purchase programmes (quantitative easing) to influence long-term rates as well, forward guidance on rate expectations, longer-term refinancing operations to bolster bank lending and negative deposit facility rates.

The stances taken by the Fed and the ECB in their policies had been similar since 2008, except during a period between 2015 and 2019 when the Fed normalised its policy by raising its rates while the ECB maintained a low-rate policy. The ECB tended to have a more delayed response to the first few crises than the Fed, but it managed to adapt its instruments just as quickly and robustly to deal with the pandemic.

Soaring inflation in the wake of the pandemic, which has been significantly above the Fed and ECB inflation targets since 2022, has driven the two central banks to tighten monetary policy rapidly (see Chart).