How Does the European Union’s Carbon Market Impact Firm Productivity?

The European Union Emissions Trading System (EU ETS) was created in 2005 to reduce greenhouse gas emissions from emitting sectors in the EU. Its impact on productivity is unclear, however, as it imposes constraints on production processes. This paper shows that the EU ETS was not detrimental to firm productivity from 2005 to 2017, despite heterogeneous effects depending on factors such as a firm’s initial productivity, size, financial constraints, sector and country (France, Italy, Spain).

The European Union Emissions Trading System (EU ETS) was introduced in 2005 to reduce greenhouse gas (GHG) emissions from the electricity and heat generation sectors, energy-intensive industry sectors (e.g. refineries, metals, cement, chemicals, glass, polymers, paper, cardboard) and intra-EU commercial aviation. It lowers GHG emissions in a cost-effective manner, without favouring a particular technology. Installations regulated by the EU ETS are required to obtain allowances (either purchased on the market or allocated for free) that match their actual emissions, incentivising them to invest in decarbonising their production processes.

Our paper seeks to examine the effect of the EU ETS on the productivity of firms regulated by the system. In the short term, it is reasonable to expect a negative effect, with the carbon price signal increasing costs, particularly for the production of emissions-intensive goods. However, the EU ETS also changes firms’ investment plans by encouraging investment in low-carbon technologies. In the medium- to long-term, emissions costs can thus ultimately be reduced and firms’ performance improved.

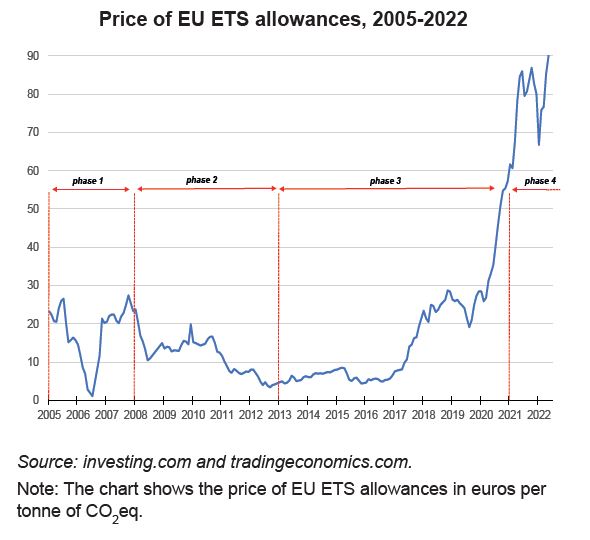

The empirical literature on the subject offers inconclusive results which vary depending on the phases examined (e.g. the pilot phase of the EU ETS, which was relatively unrestrictive in terms of the price of the allowances compared with the most recent, more ambitious phase, see Chart to the right) and from country to country. An examination of manufacturing firms in France, Italy and Spain shows that the EU ETS was not detrimental (insignificant aggregate effect) to average productivity over the 2005 to 2017 period.

Nevertheless, the system’s effects are heterogeneous. Among the EU ETS-regulated firms we examined, its effects on productivity were more positive overall for firms close to the technology frontier or financially unconstrained firms, i.e. those best positioned to invest in decarbonisation.