Competition in the French Electronic Communications Market

Having been traditionally operated by monopolies, telecom networks were gradually and successfully opened to competition as from the 1990s. In 2022, there are four major fixed and mobile operators competing fiercely with each other on the consumer market in France. This situation means that prices are amongst the lowest in Europe with huge investments being made. Competition is not as strong on the business market.

Historically operated by public or private monopolies, electronic communications networks were gradually opened up to competition across Europe from the 1990s onwards. In order to coordinate this process and ensure that incumbent monopolies do not abuse their position to disadvantage new entrants, a regulatory framework was established in each European country. In France, the regulatory framework was expanded in the early 2010s to prepare for the rollout of new fibre optic networks so as to maintain the competitive dynamics in place.

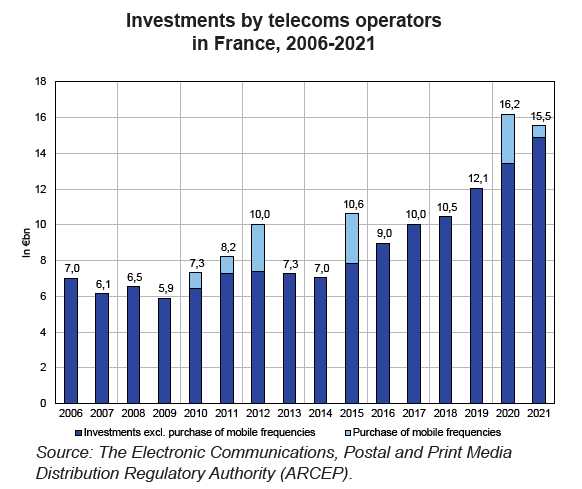

As of 2022, four major fixed and mobile operators share the highly competitive French consumer electronic communications market. This intense competition is reflected in prices that are among the lowest in Europe. Furthermore, operators have been making significant investments (€14.9bn in 2021, excluding mobile licences) that have surged over the past few years, despite stable revenues (41% of turnover in 2021 versus 26% in 1998), due to the rollout of fibre optics in fixed networks. The investments made by these operators are some of the most robust on a European level.

Competition is not as intense in the business market, despite its essential role in ensuring the digitalisation and competitiveness of companies. In 2022, just one operator held a vast majority of the market share. One of the regulator’s priorities is to increase the competition of this market which is structurally slower to develop given major barriers to switching operators.

Opening telecoms networks up to competition has broadly been a success in France and Europe. This has not prevented incumbent European operators from maintaining a significant foothold in new networks: in late 2021, Orange retained over 56% of fibre optic fixed access deployments in France.