The Development of Chinese Financial Markets

Since the 1990s, China has experienced a strong development of its equity and bond markets, structured around the Shenzhen and Shanghai markets. However, their liberalisation and opening to foreign capital remain incomplete. In recent years, Chinese financial markets have undergone a series of reforms, with the dual objective of financing innovation and the ecological transition on the one hand, and limiting risks and their lack of transparency on the other.

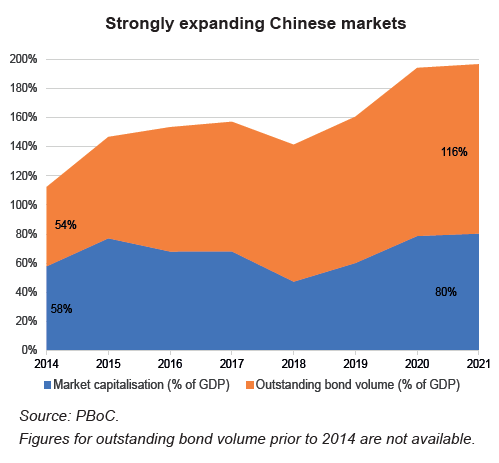

Since the 1990s, Chinese financial markets have expanded very significantly. Shanghai and Shenzhen are now respectively the world’s third and sixth largest stock exchanges by market capitalisation (see Chart on this page). In the past, China relied on its large State-run banks to finance its economy and these banks still wield substantial influence today. However, the need for modern and efficient capital markets is well acknowledged by the Chinese authorities, in order to meet the challenges of innovation and greening. In addition, the development of investment opportunities for households and businesses represents a lynchpin for economic and financial stability in light of the high level of savings.

Although the expansion of financial markets has been rapid, it is not yet complete. Their functioning is impeded by major State intervention, inefficient structuring and the fact that they are still relatively unsophisticated. Some of these problems are in the process of being rectified through structural and prudential reform, including opening up the markets internationally.

Despite persistent capital control measures, the opening of the markets is ongoing but in a conservative and limited manner. Hong Kong, where Mainland Chinese firms account for 80% of the market capitalisation, is still paramount for both international investors’ access to Chinese markets and Chinese access to global markets. Concurrently, mainland China is becoming increasingly accessible for foreign investors.

The Chinese authorities were shaken by the 1997 Asian crisis, the 2008 financial crisis and the 2015 stock market crash. The two keywords are therefore modernisation and regulation as the authorities are looking to structure credit, rate and operational risk management, and make the markets more transparent and less procyclical.