The Distribution of Losses Caused by the Energy Terms of Trade Shock

In 2022, the rise in energy prices caused a significant loss of real income for France, a net importer of oil and gas. In this paper, the Directorate General of the Treasury estimates the gross cost of this shock prior to its propagation and behavioural changes. The various channels that can be used to mitigate real income loss and the support measures to address it are discussed, as is the distribution of losses between the government, businesses and households.

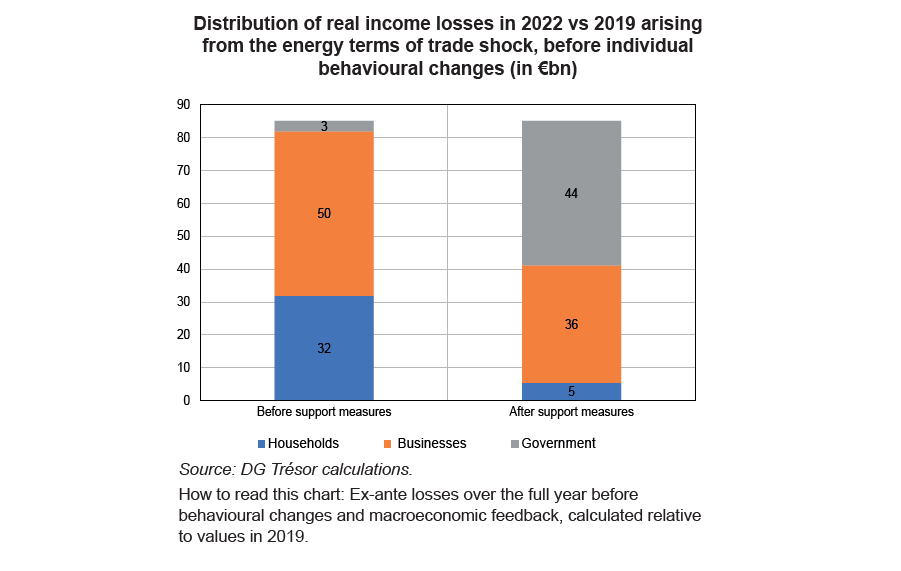

In 2022, the rise in energy prices and the depreciation of the euro caused a deterioration in France’s terms of trade, defined as the ratio between export and import prices. As France is a net importer of oil and gas, the increase in their relative price automatically reduces the country’s real income, i.e. its purchasing power. At the end of 2022, this loss in real income could reach €85bn, representing around 3 percentage points of GDP compared to 2019 (pre-pandemic levels).

This estimate is obtained in a static ex-ante framework in order to isolate the energy shock prior to its propagation and behavioural changes. In a dynamic framework, import volumes may decline when prices increase, which can explain French Customs’ slightly lower projection that the country’s energy costs will cause GDP to fall by 2.5 percentage points. Businesses may also pass on some of the price increases to their exports: when taking into account price changes of non-energy imports and exports, the terms-of-trade shock declines to around 1.5 percentage points of GDP.

With support measures, the French government is expected to shoulder more than half of real income losses in 2022, while households and businesses would directly bear 6% and 42% of the remaining estimated losses, respectively. As businesses would be able to pass on some of the rise in input prices to consumers relatively quickly and massively, it would add as much to the cost burden on households.

These support measures have been effective at curbing inflation in France – which in October 2022 had the lowest rate of inflation of all European Union (EU) Member States, – protecting household purchasing power and preventing bankruptcies. However, effective energy-saving measures are also needed in order to facilitate changes to energy consumption behaviour.

Currently funded by debt, the measures transfer the cost burden of France’s energy expenses on tomorrow’s generations. Although smoothing the cost over time is warranted given the magnitude of the shock, this offsetting cannot be a permanent solution.