An indicator of the financial cycle in France since the beginning of the 2000s

The financial crisis of 2008-2009 underlined the importance of preserving financial stability, highlighting the need for new indicators to better understand the evolution of financial risks. Regulators and academics have developed the concept of the financial cycle to measure these vulnerabilities. In this study, DG Treasury presents indicators describing the evolution of the financial cycle for France.

The 2008-2009 financial crisis accentuated the focus on financial stability and highlighted the need to develop new tools and indicators, particularly in terms of macroprudential policy, to better understand the development of financial risks.

Economic authorities – central banks, national Treasuries, market authorities, etc. – along with the academic community acknowledged the role of the financial cycle as an important proxy of these weaknesses. An indicator of the cycle can help understand its current state and the corresponding level of financial risk, based on the evolution of the variables underlying it. Yet, a number of different techniques can be used to develop this indicator.

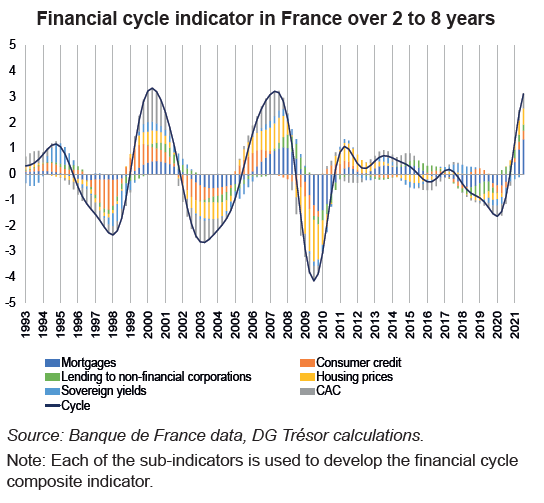

The Directorate General of the Treasury developed two indicators to measure the financial cycle in France, with one covering short cycles (2 to 8 years) and the other covering longer cycles (8 to 25 years). This approach is used to analyse the build-up or reduction of financial risks over different timeframes and provide insights into the various factors driving the cycle, such as credit to corporates and households, share and housing prices and bond yields.

As an example, the 2-to-8-year French financial cycle indicator hit a high between end-2007 and early 2008, driven by mortgages, residential housing prices and the equity market (see Chart). Their downturn and subsequent swift plunge into negative territory coincided with the subprime crisis in the United States, which then spread to Europe. After a low in late 2009 and a clear recovery until 2011, there was a relatively stable period that included the sovereign debt crisis in 2011-2012. The short-cycle indicator staged a clear rebound from 2021, fuelled by mortgages and housing prices.