Bond Market Borrowing by Non-Financial Corporations

Bond debt of non-financial corporations (NFCs) has risen sharply since the 2008 financial crisis, driven in particular by favourable financing conditions and tighter banking regulation. While bond debt allows NFCs to diversify their sources of financing, it can be a source of vulnerability in the current context of high inflation and economic slowdown. In China, the market is still not very liberalised.

When borrowing, non-financial corporations (NFCs) have the choice between contracting a loan and issuing bonds. Loans are obtained from a financial intermediary (usually a bank), whereas bonds are debt securities issued directly on the financial markets.

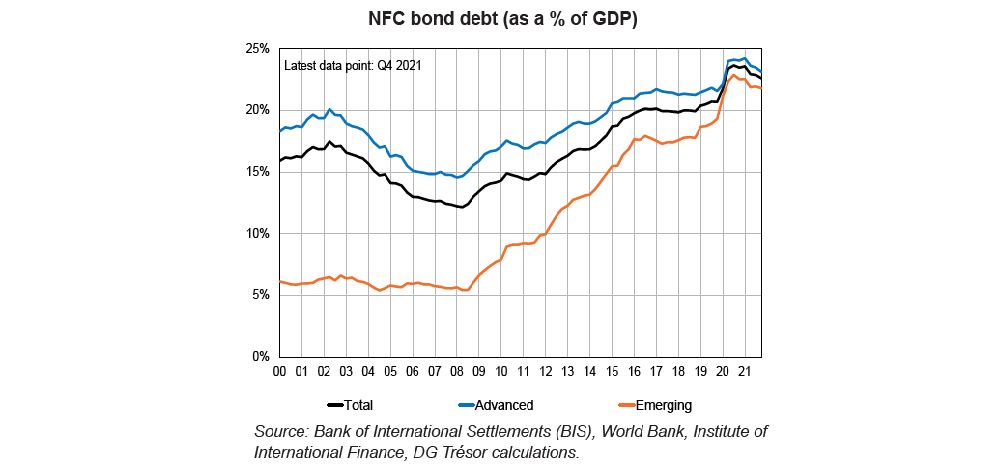

At the global level, NFC bond debt has risen sharply since the 2008 crisis (see chart on this page). Over this period, bond debt as a proportion of GDP increased twice as fast in emerging market economies as it did in advanced ones, driven largely by China.

Apart from the need for NFCs to diversify their financing sources, other factors may have contributed to the growth of the bond market since the 2008 crisis: (1) expansionary monetary policies in advanced economies supported both the supply and demand for bonds; and (2) stricter banking regulations may have led firms to replace bank loans with bonds.

Issuing bonds is a way for NFCs to diversify their financing sources and ensure a stronger rebound in periods of economic recovery. However, it can also be a source of vulnerability for the global economy:

– The ongoing normalisation of monetary policy could drive investors away from the bond market, particularly its riskier segments, making it difficult for NFCs to refinance.

– A global economic slowdown could lead to rating downgrades and fire sales of NFC bonds.

– As China opens up its bond market, now the world’s second largest after the US market, it needs to address its vulnerabilities.