World economic outlook in autumn 2022: The economy is bruised, but not broken

The global economy is facing headwinds, including higher energy prices and tighter monetary policies. It benefits from fiscal support and the gradual easing of supply pressures. As a result, global growth is expected to moderate in 2022 and 2023. The advanced economies would slow down but remain in growth. China would be penalised by the "zero Covid" strategy and Russia would record a sharp drop in GDP linked to the sanctions.

The world economy is expected to grow by 3.3% in 2022 despite record increases in commodity prices, exacerbated by Russia’s invasion of Ukraine. 2023 is also likely to be a resilient year, with projected growth of 3.1%.

Advanced economies are expected to slow amid monetary tightening and high energy prices. Still, moderate growth is forecast thanks to fiscal support measures such as the European recovery plan, room for catch-up in some countries and the gradual easing of supply chain disruptions. The United Kingdom stands out as an exception: it is projected to enter a recession in 2023, with the Bank of England abruptly raising rates in an attempt to tame particularly high inflation, a result of Brexit-related supply challenges and a lack of energy price regulation measures.

A sharp slowdown is projected for the Chinese economy, with the country’s zero-COVID policy and real estate crisis weighing on activity and government support measures doing little to help with pandemic-related uncertainty. In Russia, although capital controls and fiscal support measures helped to mitigate the immediate impact of sanctions, it looks as though the economy will enter a deep recession in 2022 and 2023.

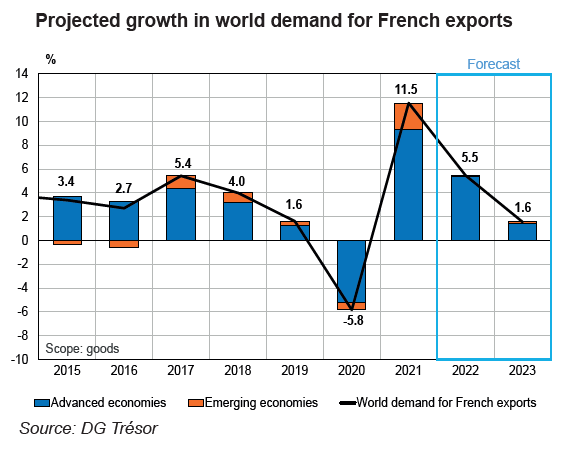

After a powerful rebound in 2021, world trade in goods will likely remain strong in 2022 before slowing more sharply in 2023 (see chart on this page). Growth in foreign demand for French goods is expected to outpace world trade growth in 2022 – as European countries catch up on trade – but lag behind in 2023.

The main risks to this international scenario are geopolitical uncertainty, energy supply, the risk of de-anchored inflation expectations, policy-mix developments and climate risks.