The Income Balance in France and in the Euro Area

The French income balance, which is a component of the current account like the trade balance in goods and services, is one of the few in the euro area to show a surplus. This surplus is driven by income from investments abroad and by the remuneration of cross-border employees. The health crisis has resulted in a deterioration of the income balance in France, as in the euro area.

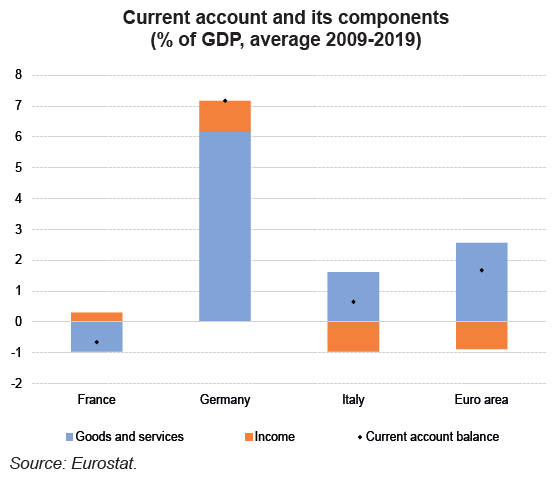

The income balance and the goods and services trade balance are the two components of the current account. France, along with Germany, is one of the few euro area countries with an income balance surplus. The surplus was relatively stable averaging about €7bn, or 0.3% of GDP, between 2009 and 2019. This surplus partially offsets France’s trade deficit.

The income balance encompasses a wide variety of flows, including income from French investments in foreign companies. This income comes from direct investments abroad (equity stakes exceeding 10%) and portfolio investments. Compensation of cross-border workers, government transfers, such as international development aid, and remittances of foreign workers in France to their home countries are also part of the balance of income.

Between 2009 and 2019, the surplus on France’s income balance stemmed from French businesses’ foreign direct investment income and from the compensation of cross-border workers. France’s income balance surplus is much larger than those of its European counterparts. On the other hand, France and the euro area as a whole register structural deficits on portfolio investment income, government transfers and foreign workers’ remittances.

The income balance has worsened in France and other euro area countries since the pandemic. The deterioration is primarily due to the fall in French foreign subsidiaries earnings, which had a major impact on investment income. The impact of the pandemic on compensation of employees was less severe since the switch to remote and short-time working made it possible for cross-border workers to keep their jobs.