Analysis of France’s State-Guaranteed Loan Scheme at End-2021

Around €145bn in state-guaranteed loans (SGLs) have been granted to French companies since the beginning of the health crisis. These EGPs have mainly gone to viable companies in temporary need of liquidity, particularly in the sectors most affected by the crisis. The available data show that they have only been partially used. At this stage, the expected net losses represent less than 1% of the volume granted by the scheme.

At the onset of the COVID-19 crisis, France launched a State-guaranteed loan (prêts garantis par l’État – PGE) scheme to meet the urgent cash needs of firms. At end-2021, more than a year and a half after these loans were introduced, some €145bn had been lent out to more than 700,000 firms, with over three quarters of that volume disbursed between March and June 2020.

The primary recipients of PGE loans were smaller firms and firms operating in the sectors hardest hit by the crisis. These loans mainly went to firms experiencing temporary cash flow needs, while uptake from firms already in difficulty before the crisis remained low.

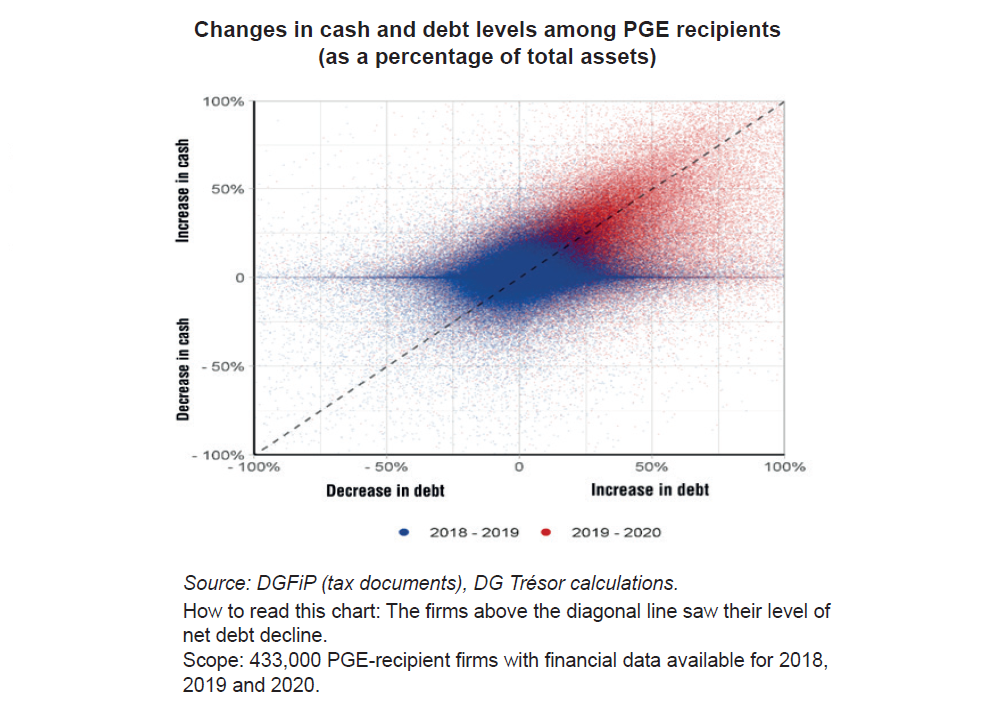

According to surveys on how firms used the loans, many borrowed funds as a precautionary measure and only tapped into a small portion of their credit. There has been no widespread substitution of PGEs for other bank debt.

Although PGE recipients saw their debt levels rise, so did their cash levels, resulting in generally stable levels of net debt.

Based on available surveys for 2021, it does not seem there will be any particular difficulties with repayment. Only 5% of firms foresee having difficulty making their payments. Current estimates produced in partnership with the Banque de France peg the anticipated gross loss ratio at 3%.