Business Failures in France during the COVID-19 Crisis

The number of business failures fell sharply during the Covid crisis. Public support prevented many companies from going bankrupt, particularly the smallest and those in the sectors most affected by the crisis. However, an analysis of the companies that failed shows that market selection continued to play a role, with the most fragile companies continuing to enter into legal proceedings during the crisis.

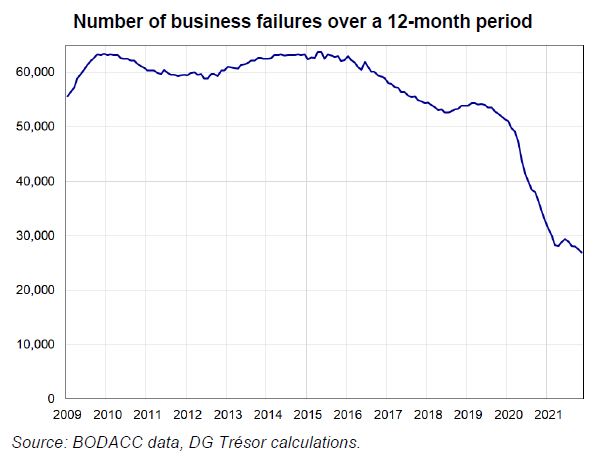

French government support for businesses during the COVID-19 pandemic-induced economic crisis helped avert a wave of bankruptcies. In 2020, support measures led to a record-breaking year-on-year drop in the number of business failures (i.e. court-ordered reorganisations or liquidations), with 31,000 recorded that year, compared to 50,000 in 2019. This trend continued in 2021, with a total of 40,000 bankruptcies "avoided" from March 2020 to October 2021, or a 45% decline compared to the equivalent pre-pandemic period.

Thanks to government support measures, the sectors hardest hit by the COVID-19 crisis and the rest of the economy have recorded a similar drop in bankruptcies. On a more granular scale, however, certain subsectors severely affected by the crisis saw virtually no change in the number of bankruptcies.

While the number of bankruptcies among small and medium-sized enterprises (SMEs) fell shortly after the end of the first lockdown, bankruptcies increased among the largest firms. This temporary rise delayed the fall in the number of jobs affected by business failures.

Reorganisations were down 59%, whereas liquidations fell by a lower 39%. The financial situation of failing firms during the crisis was worse than in normal circumstances, with the most vulnerable firms continuing to go bankrupt, while government support was keeping better-off companies afloat.

Although market selection remained at work during the crisis, an econometric analysis shows that its effectiveness was diminished, indicating that the crisis blurred the typical determinants of bankruptcy.