France's Sovereign Debt Issuance Strategy

The French sovereign debt issuance strategy has two main objectives: to ensure financing at the best cost for the taxpayer and to limit the debt refinancing risk. Agence France Trésor's issuance policy translates these objectives into practice by maximising the liquidity of its bonds and ensuring that it maintains a permanent capacity to place its securities with a diversified and resilient investor base.

For a given deficit, the objective of Agence France Trésor (AFT), the agency responsible for managing the French government's debt, is to minimise borrowing costs and run the funding programme under the most secure conditions possible. This involves ensuring the liquidity of the government's debt securities (the main endogenous factor in bond pricing) and basing its issuance policy and the structure of its debt market on the principles of consistency, predictability and flexibility.

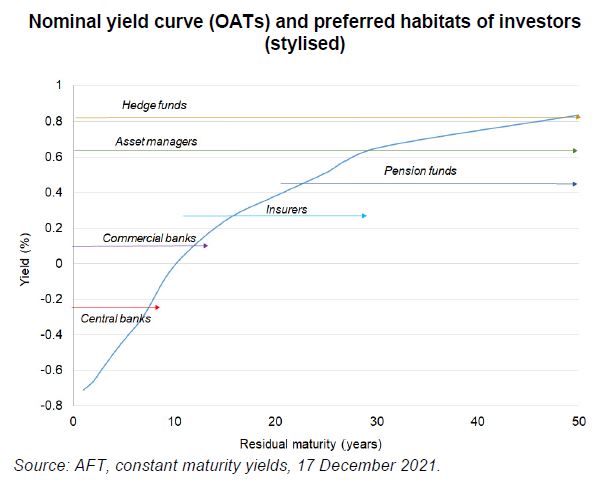

AFT's issuance policy is based on its understanding of the preferred habitats of investors, i.e. their preferences in terms of maturities (see chart below), in order to adjust to these preferences and thereby obtain the best possible financing conditions. There are indeed regulatory, financial and economic factors specific to each class of investors that influence demand for debt securities, based on which AFT adjusts its issuance policy and places investment products on the market, such as inflation-linked bonds and green bonds.

AFT's management of refinancing risk involves smoothing borrowing needs over time and maintaining permanent market access for its debt. The average maturity of an issuer's debt is largely the result of the past and projected composition of the demand for securities and the composition of savings in the currency of issuance. France has a stable and diversified investor base that provides resilience when rates fluctuate.

Since 2003, the average maturity of French debt has increased by 2.4 years. At end-2020, it stood at 8.2 years, one of the longest maturities among advanced economies. Very low interest rates are not necessarily an argument for lengthening the average maturity any further than what results from structural demand. A simple modelling study suggests that the cost of extending average maturity outweighs the anticipated gain in the event of a future rise in interest rates, and that any potential gain is limited vis-à-vis the total cost of debt service, even in an optimistic scenario.