Assessment of the 2008 Reform of the Research Tax Credit

The research tax credit (CIR) is a tax measure to support companies' research and development (R&D) activities. Following the 2008 reform of the CIR, the claims associated with the CIR increased from €1.8bn in 2007 to €6.5bn in 2018. Existing studies highlight the positive effects of the reform at the microeconomic level. Evaluated using the DG Treasury's Mésange model, the CIR reform would have increased activity by 0.5 points of GDP 15 years later.

The research tax credit (CIR), which was introduced in France in 1983, is a tax scheme to support businesses' R&D. The amount of the tax credit is calculated on the basis of R&D expenditure and offset against corporation tax. The measure underwent a reform in 2008, at which point the tax credit stopped factoring in the increase in expenditure in order to be calculated solely on the volume of expenditure, at a rate of 30% up to €100m and 5% thereafter.

The 2008 reform generated a sharp rise in government expenditure in support of private-sector R&D. Subsequently, accrued research tax credits jumped from €1.8bn in 2007 to €6.5bn in 2018, thus making the tax credit the main R&D support scheme available to businesses in France. By stimulating companies' R&D expenditure, the reform fosters both innovation and productivity, which are crucial for long-term growth and competitiveness.

Existing studies highlight the positive impact of the research tax credit reform at the microeconomic level, especially in terms of R&D expenditure and productivity of beneficiary companies. In 2019, the French Innovation Policy Assessment Commission (CNEPI) published initial microeconomic assessments which set forth an additionality effect following the 2008 reform, namely that one euro of research tax credit leads to one additional euro of private-sector R&D expenditure. As such, the reform has helped increase the level of private-sector R&D expenditure in France. Nevertheless, the CNEPI's most recent report in 2021 found that the effects of the reform have been heterogeneous depending on company size, substantial for firms with less than 250 employees but non-significant for larger businesses.

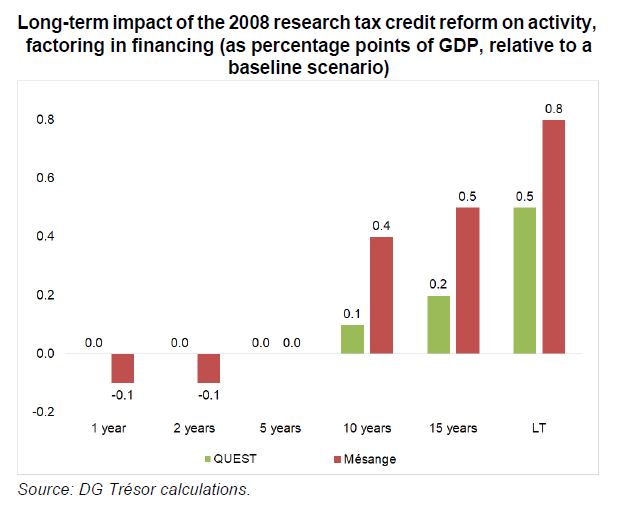

When assessed using the DG Trésor's Mésange model, it is estimated that the reform will have increased economic activity by 0.5 percentage points of GDP and enabled the creation of 30,000 jobs after 15 years, as its impact on the economy is felt with a lag. In the longer term, the reform should boost activity by 0.8 percentage points of GDP and create 60,000 jobs. These effects take account of the funding of the reform through a cut in government expenditure, excluding the research tax credit. That said, they are still shrouded in great uncertainty.