Employee Financial Participation Schemes in France and Europe

9 million employees in France are covered by a value-sharing scheme: profit-sharing, participation or employee share ownership. They are present in all European countries, but differ in form or implementation. Some countries do not intervene; others adopt a more proactive strategy. France stands out for both the wide spread and the institutionalisation of these systems. It is the only country to have made certain measures compulsory.

Financial participation schemes are designed to incentivise employees to participate in the success and capital of the companies they work for. France, which first introduced financial participation in 1959, has two types of profit-sharing schemes – intéressement and participation – under which employees receive a bonus depending on how well the company performs. These schemes covered nearly 9 million French workers in 2018.

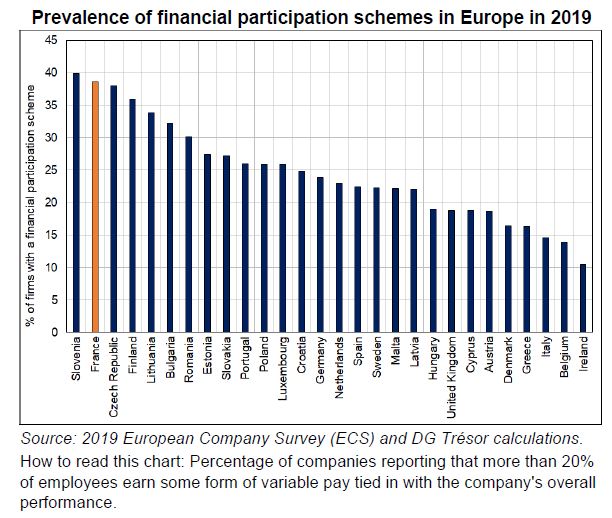

Financial participation schemes exist across Europe, with varying degrees of coverage depending on the country. Whereas many do not regulate or encourage such schemes, others, such as France, the United Kingdom and the Netherlands, take a more proactive approach.

In France, major reforms have been underway since the 2019 Business Growth and Transformation Action Plan Act (PACTE Act) to boost the prevalence of financial participation schemes and make it easier to implement and administer them, particularly for small businesses, among which coverage is low.

France is unique in that financial participation schemes are very widespread, highly institutionalised and an integral part of labour relations. Among European countries, it has one of the highest coverage rates of such schemes, well ahead of its comparably sized neighbours.

One reason for this widespread prevalence is that participation is mandatory for certain categories of companies. There are also tax incentives in place to encourage uptake.