TARGET2 Imbalances in the Euro Area

TARGET2 is the Eurosystem's own system, which is essential for the functioning of the euro area and allows the settlement of financial transactions between commercial banks located in different countries of the euro area. The balances associated with TARGET2 have increased since 2008 as a result of the ECB's monetary policy. They are expected to decline with, inter alia, the gradual end of the ECB's purchase programmes, and as Banking Union and Capital Markets Union progress.

The Trans-European Automated Real-time Gross Settlement Express Transfer System, or TARGET2, allows financial transactions to be settled between commercial banks located in different euro-area countries via a clearing system between national central banks (NCBs) and the European Central Bank (ECB). Transactions accumulate in net terms, resulting in a balance which is recorded on the balance sheet of each NCB.

TARGET2 balances are therefore an accounting representation of the cross-border economic and financial relationships that the free movement of capital in the euro area entails. In addition to trade in goods and services and portfolio investments, these balances reflect a variety of different types of flows of funds: flows between subsidiaries or branches of the same banking group that participate in TARGET2 via different NCBs, flows resulting from non-standard monetary policy measures, and "technical" flows associated with the location of accounts for the settlement operations of securities.

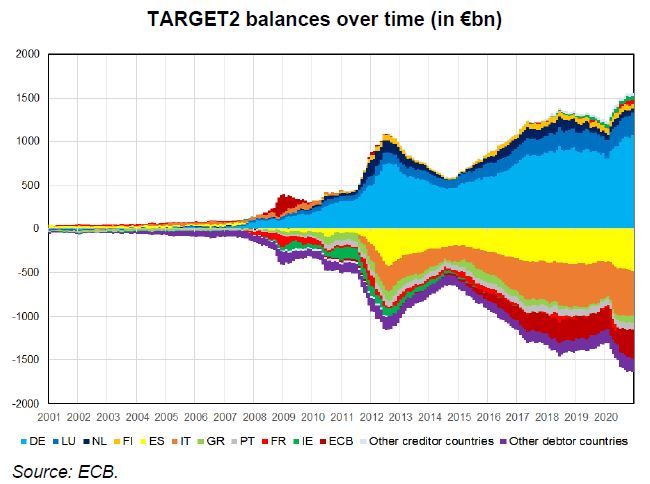

Since the euro was created, TARGET2 balances have gone through several distinct phases. Prior to 2008, balances were practically zero: current account imbalances between euro-area countries were settled by means of interbank liquidity transfers. After the 2008 financial crisis and the 2012 sovereign debt crisis, TARGET2 balances rose dramatically due to tensions on the interbank market and a flight of deposits from "peripheral" countries (Italy, Greece, Spain, Portugal, Ireland) toward "core" countries (Germany, Netherlands, Luxembourg), before gradually going back down. Since 2015, balances have been picking up again as a result of the ECB's asset purchase programmes. Today, balances are more a reflection of the differences in size between Europe's financial markets than the result of market tensions, interbank market fragmentation or capital flight.

TARGET2 balances are expected to decrease as the ECB tapers off its asset purchase programmes and, more generally, as progress is made on the Banking Union and the Capital Markets Union.