The impact of the COVID-19 pandemic on French firms

As part of the work of the Coeuré Committee, the DG Treasury has developed a micro-simulation tool to estimate the impact of the crisis, as well as of the measures put in place to respond to it, on the financial situation of French companies. The results show that although the financial situation deteriorated in 2020 compared to a year without a crisis, public policies - especially partial activity and, for small companies, the solidarity fund - have greatly limited this impact.

The COVID-19 pandemic had a very severe impact on the financial situations of French firms: they experienced a sharp drop in turnover, which in some sectors was unprecedented, and were forced to cut their expenses and borrow to meet their obligations. At the same time, they received large-scale public support.

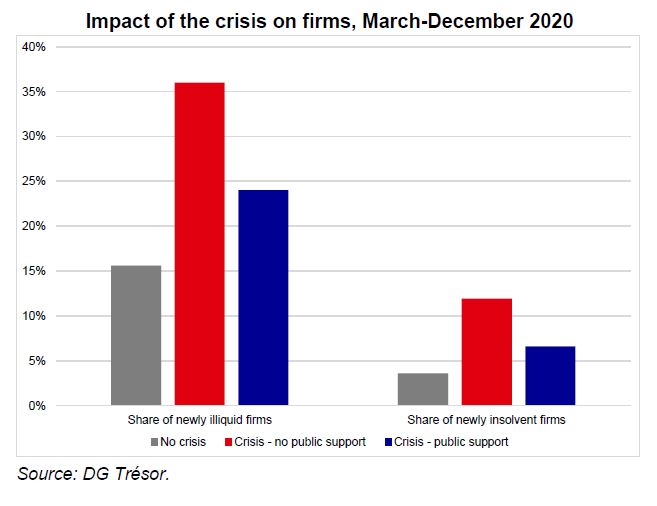

We use a microsimulation model to study the changes in the financial situation of nearly 2 million French firms in response to the shock to business activity. It incorporates firm-level data from 2020, including changes in turnover and payroll, and use of public support measures. We were able to estimate the number of firms that would become illiquid (cash flow exhausted without additional borrowing) or insolvent (amount of debt exceeding assets).

The share of newly illiquid firms is estimated to be 8.4 percentage points higher in 2020 than in a non-crisis year. The number of newly insolvent firms is estimated to be 3.0 percentage points higher. The results show the effectiveness of public support in reducing the impact of the crisis: without it, the increase in the number of newly insolvent firms (compared to a non-crisis year) would have been 8.3 percentage points.

Firms made insolvent by the crisis are on average more productive than those that become insolvent in normal times. Public support did not discriminate between firms according to productivity.

The effect of the crisis on firms' balance sheets is likely to impair corporate investment during the economic recovery. Econometric modelling suggests that crisis-related debt overhang could curtail investment by some 2% in the medium term, which justifies the use of specific measures, such as those in the recovery plan. R&D spending, traditionally less correlated with the business cycle, appears to be more resilient.