Macroprudential mortgage lending measures

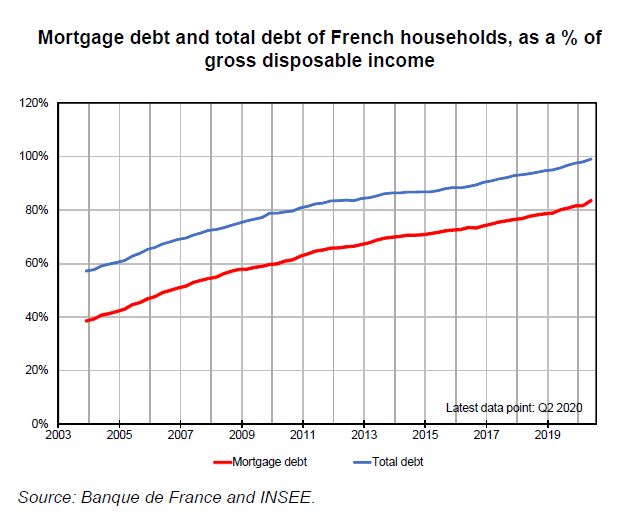

Poorly managed housing debt poses significant risks to financial stability. In France, household housing debt has doubled since 2004 as a proportion of gross disposable income. This study compares two macroprudential measures. Limiting the effort rate and maturity allows households to adjust their loan requests, while controlling the monthly debt burden. Controlling the debt ratio reduces aggregate debt but has redistributive effects.

Out-of-control mortgage lending is a source of considerable risk to financial stability. The subprime lending crisis in the United States spurred the expansion of so-called macroprudential policies, which aim to reduce financial risk for the financial system as a whole.

In France, mortgages account for 50% of bank loans held by non-financial agents and total outstanding mortgage debt exceeds one year's total disposable household income. A combination of runaway mortgage growth and deteriorating loan quality poses significant risk to financial stability.

To ensure these loans remain solid, adequately risk-assessed assets, macroprudential authorities can impose lending restrictions, for example on the ratio of debt service to income (DSTI), the ratio of debt to income (DTI), the maturity of the loan or the size of the down payment.

In December 2019, France's High Council for Financial Stability (HCSF) recommended a maximum loan maturity of 25 years and a DSTI limit of 33% (later revised to 35% in January 2021) for a majority of mortgages. The HCSF's recommendation is to become binding in the summer of 2021.

Using a property market model, we analysed the economic impact of two types of macroprudential measures: the first, limits on both DSTI ratio and loan maturity, and the second, a DTI cap. Both succeed in reducing the overall debt level, but the effect of the combined limitation is less pronounced, since it allows some households to extend maturity in order to circumvent the cap on DSTI ratio. The measure directly targeting DTI ratio has a stronger impact on prices and transactions and generates more significant distributive effects.