Venture capital and development of French start-ups

The high mortality of start-ups in the industrialisation phase ("Death Valley") appears lower in France than internationally. Start-ups' sustained need for external funding makes them vulnerable to "predatory acquisitions", whose aim is to remove the innovation from the target. These acquisitions remain moderate, however (less than 6% of start-up purchases by large groups in France).

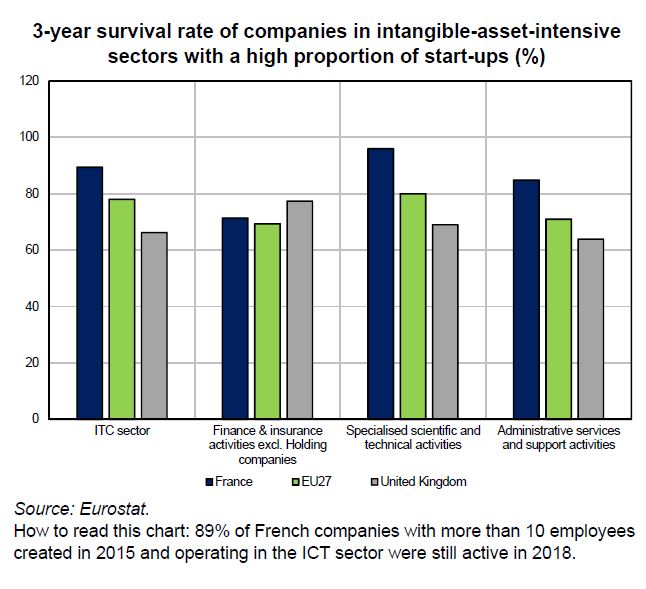

There are typically four stages in the development of a start-up: incubation, seed funding, implementation, and growth. Start-ups often face cash flow difficulties between the implementation and growth phases, resulting in a high death rate. An analysis of the three-year survival rate of companies operating in the ICT and specialised scientific and technical sectors shows that this phenomenon, known as the "Valley of Death", exists in France, although it seems less prevalent than in other countries.

Start-ups are a particularly uncertain asset class for investors. The structure of their balance sheets (high share of intangible assets) and the lack of historical profits make it difficult to use traditional financial valuation techniques, resulting in a high level of information asymmetry between investors and entrepreneurs, which makes effective cooperation difficult.

Traditional financing through bank loans is difficult to put in place in the absence of tangible collateral on a start-up's balance sheet. This is why specialised investors known as venture capitalists step in to provide equity financing. The availability and selectivity of venture capital funding determine whether start-ups can effectively grow and the magnitude of the "Valley of Death".

In France, start-up financing difficulties seem to be less severe than elsewhere in Europe (EU27 and UK). Bpifrance has been the primary catalyst for the growth of French venture capital. France has a vibrant pool of start-ups and is now ranked first in the EU27 in terms of fundraising for rounds under €100m, followed by Germany. However, France, as well as continental Europe, are slightly lagging behind when it comes to financing late stages rounds (segment corresponding to the growth phase), which are crucial for start-ups to scale up and reach a critical size.