2021, zombie year?

According to the Banque de France, the gross leverage of non-financial corporations increased by € 174.5 billion in France, including € 120.7 billion in State-guaranteed loans (PGE) between February and September 2020. This additional leverage, which represents just over 7 percent of 2019 GDP, adds to the pre-crisis debt-to-GDP ratio of 73.5 percent (see HCSF, 2020). The PGE is a flexible loan - firms can reschedule it for up to 5 years and benefit from low interest rates. It is nonetheless a debt that firms will eventually have to pay off. They may then have to sacrifice investment in order to secure repayment: the economic literature (see for example Kalemli-Özcan, Laeven and Moreno, 2020) emphasizes that a debt overhang weighs on investment, and therefore on growth. Some firms will not survive: according to Cros, Epaulard and Martin (2020), a company's debt ratio is a major determinant, alongside its productivity, in predicting future failure.

Schumpeter against the PGE?

From a sharp Schumpeterian perspective of “creative destruction”, the Covid-19 crisis could regenerate the French productive fabric by eliminating the least productive firms, freeing capital and labor for more innovative and productive businesses. Contrary to popular belief, the process of creative destruction works rather well in normal times in France (Ben Hassine, Le Grand and Mathieu, 2019; David, Faquet and Rachiq, 2020).

However, the Covid-19 crisis hits businesses in an undifferentiated way. As early as June 2020, OFCE warned of the risk that an abnormal proportion of highly productive businesses could fall into insolvency as a result of the crisis. In general, economists have validated the choice of many European countries, including France, to support businesses based on administrative closures and loss of turnover, with no condition on their pre-crisis financial situation. Inevitably, non-viable businesses were protected during the year 2020. Have they been over-protected?

Zombification not proven so far

The OECD qualifies as zombie a company aged ten years or more whose annual results fall short of interest payments, so that the debt increases steadily. These firms cannot invest in productive capital, let alone R&D; they survive and become a drag for growth. Will the legacy debt left by the crisis inflate the number of zombie firms in France, when, according to the OECD, their number was relatively limited before the crisis, by international comparison? Will public support - solidarity fund, short time work in particular - just mask the non-viability of a large number of firms for a time, without solving their root problem?

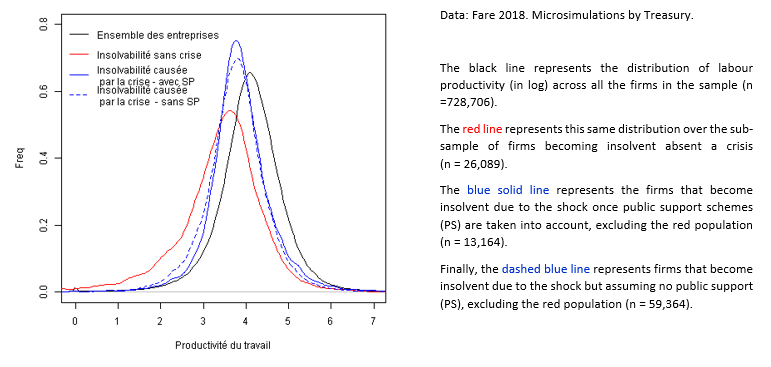

The simulations carried out by the French Treasury (see box below) do not validate such a scenario. Taking into account both the decline in activity by sector during the year 2020, and the main public support mechanisms for more than 700,000 businesses employing workers and viable before the outbreak of the crisis, we observe that the debt accumulated due to the crisis shifts slightly to the right the distribution of businesses at risk of insolvency: firms at risk of insolvency due to the crisis (blue line on the graph) are on average slightly more productive than those that would have been at risk in normal times (red line). However, those firms becoming insolvent due to the crisis still display lower productivity than average (black curve): firms with lower productivity are indeed the most at risk. Finally, public support (solidarity fund, short-time work), while reducing the number of firms at risk, do not modify their distribution in terms of productivity: the blue solid line (with support) is very close to the blue dotted line (without support).

Simulation results: distribution of labor productivity

Interpretation: each line represents the distribution of productivity within a sample of firms.

Source: French Treasury.

These simulations confirm the diagnosis of Bach et al. (2020) for the Institute of Public Policies, according to which the Covid-19 crisis has hit relatively unproductive businesses harder, with a marked sectoral effect (hotels and restaurants, transport, culture, etc.). It has also affected, in fewer numbers, more productive businesses that should not have faced an insolvency problem under normal conditions. If less productive firms have received more support on average, it is because they have been more severely hit by the crisis rather than due to a bias in public support in their favor: the aid has made it possible to drastically reduce the number of businesses at risk of insolvency, without selecting the most productive nor the least productive.

According to Cros, Epaulard and Martin for the Economic Analysis Council, corporate failures fell sharply in 2020 compared to 2019, but within failing businesses, the same factors (mainly productivity and debt) explain the failures in 2020 as in 2019. This confirms the neutrality of the support mechanisms deployed in 2020: the “zombification” of the economy is not there yet.

The year of danger

The indebtedness of French businesses at the end of 2020 is difficult to interpret for four reasons. The first is that, while leverage was high and growing in percent of GDP before the crisis, it was not necessarily the case in percent of total assets, especially for SMEs: the increase in debt was indeed accompanied by a parallel increase in corporate equity (see HCSF, 2020). The second reason is that businesses have accumulated cash almost equivalent to their additional debt since the start of the crisis; at the aggregate level, their net indebtedness has therefore only very slightly increased. The third reason is that businesses are also indebted to the state and social security. As of mid-November 2020, nearly € 23 billion in social contributions remained owed by French firms, according to the Business Aid Monitoring Committee. The last reason, finally, is the great heterogeneity of businesses, even within the same sector: businesses that have accumulated cash are not necessarily the same as those that have accumulated debt.

How to avoid a zombification of French businesses? Existing work on the topic identifies two key factors: restructuring procedures and the health of banks.

- Efficient restructuring procedures: Jordà et al. (2020) like the OECD (2017) consider the speed and efficiency of restructuring procedures as a key element in avoiding "zombification". In particular, early procedures are strongly encouraged. In the French case, Epaulard and Zapha (2020) show that, for two similar businesses, the safeguard procedure (before cessation of payments) produces much better results than judicial reorganization. The current transposition of the European directive on restructuring and insolvency provides an opportunity to strengthen the system by shortening the safeguard procedure, developing early warning systems and confidential procedures (conciliation, ad hoc mandate), providing reliable statistical information on survival rates and, finally, by facilitating the adoption of debt restructuring plans with an increased role of creditors compared to shareholders and incentive voting rules.

- Healthy banks: since the study of the Japanese crisis in the 1990s (Caballero, Hoshi and Kashyap, 2008), economists have considered that well-capitalized banks are less likely than others to maintain credit lines to non-viable businesses because they can provision non-performing loans without risking appearing under-capitalized. From this point of view, we must welcome the recapitalization effort of French banks since the 2008 crisis: the CET1 capital ratio of the main French banks rose from 6% on average in 2008 to 14% in 2019 (HCSF, 2020). The deployment of the PGE nonetheless raises the question of the selectivity of loans: distributed widely, it could artificially keep low-productivity businesses alive, which would slow down the recovery after the crisis by blocking the reallocation of production factors towards more productive businesses. For Schivardi, Sette and Tabellini (2020), though, the idea that supporting fragile businesses would come at the expense of dynamic businesses does not hold water. Indeed, the crisis entails two simultaneous effects: increasing the share of fragile enterprises and reducing the growth of healthy ones, without the former being necessarily the cause of the latter. Moreover, it is still too early to judge which businesses are promising. Finally, we must not overestimate the capacity of the economy to reallocate production factors in the midst of an economic crisis and even after the crisis, as Patrick Artus (2020) reminds us.

What conclusion should we draw from all this? First, an effort is desirable to promote preventive, confidential or public restructuring procedures, still too rarely used in France. Second, banks capitalization must be protected, in particular by limiting the distribution of bonuses and dividends, as the European Central Bank once again recommended on December 15, 2020. Finally, for another few months, the Schumpeterian argument will have to wait: because uncertainty will remain as to the lasting impact of the crisis on business models, the objective will still be to limit liquidations in order to preserve the productive fabric and skills. Businesses will have to seize the opportunities offered to reschedule PGEs, open their capital to new investors (in particular via the « Label Relance » funds) and repair their balance sheets with future quasi-equity loans.

French Treasury simulation method (December 2020)

The simulations presented above are based on the latest known balance sheets (Fare 2018) of 728,706 French businesses employing paid staff, to which sectoral shocks are applied based on INSEE data (17 sectors including trade, accommodation-catering, transport): quarterly national accounts for the first three quarters of 2020 and, for the last quarter, the estimates of the economic outlook of Insee of November 17, 2020, which therefore include the deterioration of the economy during the second lockdown.

The operating costs identified as variable costs (supplies) are supposed to adapt to the shock with a certain time lag, the calibration of which changes during the year 2020. Meanwhile the costs identified as fixed costs (in particular the payroll, taxes and rents) remain constant.

The short-time work scheme is supposed to cover the payroll in a proportion equivalent to the loss of activity (no retention of labor). For the solidarity fund, eligible businesses are identified at individual level and the amount awarded is determined from the amount actually paid by sector. These schemes act as subsidies and raise profit.

The financial statement of each company is updated by simulation every quarter. A company whose cash flow becomes negative is supposed to go into debt to cover its liquidity gap, which raises its leverage. A company whose debt exceeds the amount of its assets is considered insolvent. The concept of insolvency is different from that of default: a company may be insolvent but not be in default.

Without an economic shock, some businesses would nevertheless have become insolvent due to an unsustainable financial structure: the approach adopted here consists in comparing, at the end of 2020, the characteristics - and in particular the distribution of productivity - of firms becoming insolvent due to the crisis to those firms that would have become insolvent even without a crisis (insolvent firms at the start of the simulation being excluded from the analysis).

The methodology will be detailed in a forthcoming Treasury working paper by Benjamin Hadjibeyli, Guillaume Roulleau and Arthur Bauer. This technical document will also present a new set of simulations in which the economic shocks will be assessed at the level of each company and the effective take-up of the various support mechanisms (solidarity fund, short-time work, deferral of social security contributions) will also be taken into account at individual level.

Read more :

>> Version française : 2021, l'année des zombis ?

>> All posts by Agnès Bénassy-Quéré, chief economist - French Treasury