The international strategies of France's business sector

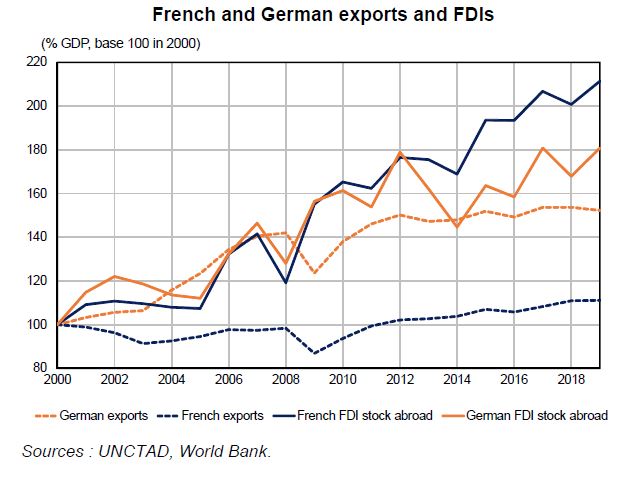

Since the early 2000s, French companies have favored investments rather than exports to develop internationally. These strategies, which may have affected the added value produced in France, reflect a loss of competitiveness, a positioning in the mid-range market or the predominance of large companies. The fiscal and structural reforms of recent years and the Covid-19 crisis could reverse this trend.

When a business goes international, it can either export from its home market or invest in local subsidiaries in its target markets. Large multinationals tend to do both. The decision is a matter of not just domestic competitiveness and target market potential, but also sector-specific factors and company culture.

After falling sharply in the 2000s, the number of French exporters trended upward between 2011 and 2019, dominated by large groups, similar to France's domestic production landscape. However, French exporters still lag behind their German counterparts in both number and performance.

France has high outgoing foreign direct investment (FDI), dividends from which have partially offset a deteriorating trade balance. It reflects a decline in France's competitiveness in the 2000s, its mid-range position in terms of quality, a production structure heavy on large corporations capable of foreign investment and cultural factors.

These increased FDIs led to a decline in domestic value-added, in contrast to Germany, whose FDIs tend to split up production processes while keeping higher value-added segments at home, which is consistent with increased production and exports.

The COVID-19 crisis is expected to further drag down already slowing global FDIs and could lead some French companies to shift strategy and develop local production capacity to secure their supply chains. That could transform France's production base and reposition the French economy in global value chains.