Two decades of economic transformation in China

The Chinese growth model, largely financed by the indebtedness of companies and local authorities, has led to strong internal imbalances (excessive debt, unstable real estate sector, fragile banking system). Although, despite the reforms implemented since 2016, the rebalancing of the economy towards domestic consumption and services is struggling to materialize, China has nevertheless seen its trade integration shrink and its financial integration strengthen.

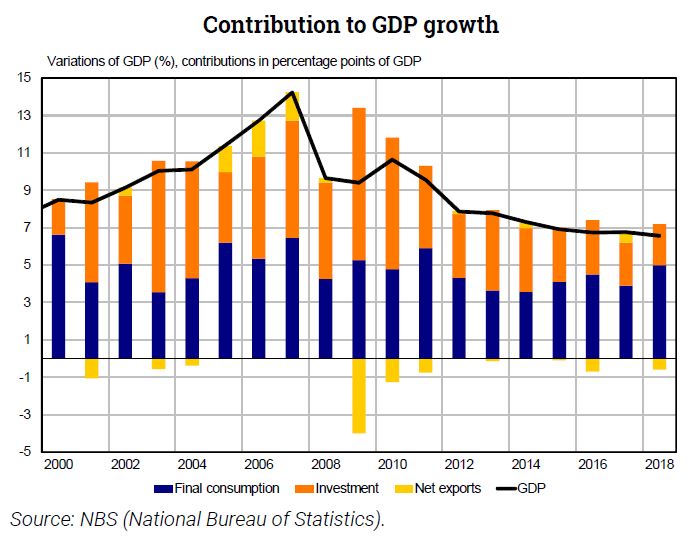

China experienced major economic changes during the two decades leading up to the recent COVID-19 pandemic. It has become one of the cornerstones of the world economy and its emergence in the noughties was driven by a growth model based on investment and integration in global value chains. After very strong real growth averaging 10% per year between 1980 and 2010, Chinese economic activity slowed down to 6.1% in 2019, its lowest rate since 1990. This was mainly due to a lesser contribution of investment to growth, reflecting a loss of steam in the growth model.

In China, GDP per capita has increased nine-fold over the past quarter century owing to the significant economic advances made over the period. This has enabled 745 million people to exit poverty. But, the Chinese growth model, which is widely funded through corporate and local government debt, has generated severe internal imbalances: (i) excessive indebtedness for all its economic agents (businesses, public sector and financial sector); (ii) an unstable real estate market which experiences frequent bubbles; (iii) a vulnerable banking system. This is compounded by excess production capacity which now puts a drag on growth. To safeguard external balances, the authorities have combined controls of capital outflows with foreign exchange controls, aiming at mitigating capital flight and currency volatility.

Since 2016, the Chinese authorities have been conducting a series of reforms to limit the risks of a disorderly correction of imbalances and to redirect the growth model towards final domestic consumption and the tertiary sector. For the time being, the rebalancing process, which takes time to gain traction, is causing a gradual slowdown in growth.

By expanding its services production and giving momentum to domestic consumption, China's trade integration has fallen; exports as a share of GDP are down and so is processing trade. To diversify its financing sources, China has bolstered its international financial integration which, in the long run, will make the global economy more exposed to Chinese domestic risks.