Trésor-Economics No. 253 - French exports of goods to the EU

France is Europe's 3rd largest exporter to the EU, despite a decline since 2000. Enlargement towards the East has indeed favoured the countries located more in the centre of Europe. France also experienced a deterioration in its cost competitiveness and its positioning in the range in the 2000s, while strengthening its positions in aeronautics and certain service sectors. Measures taken in recent years should help improve its competitiveness and performance.

Despite the increasing weight of emerging economies in global trade, the European Union remains the leading destination for trade flows in goods and France's leading export market (59% of French exports in 2018). Since 2000, trade in goods within the EU has increased sharply (100% in nominal terms between 2000 and 2018).

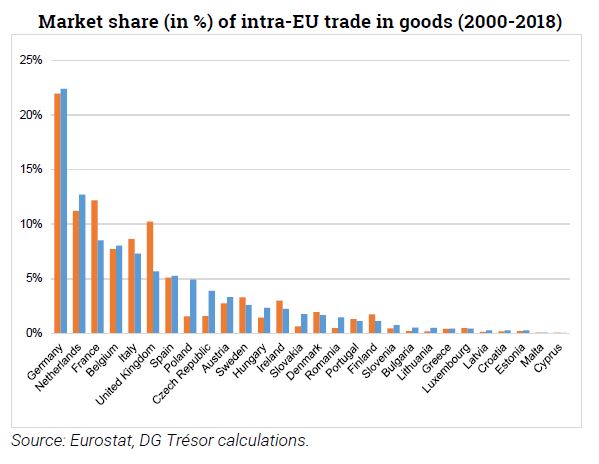

Similar to the United Kingdom and Italy, France's share in this surge has been modest: exports to Europe grew by only 26% in nominal terms, and its market share fell from 12% to 9% between 2000 and 2018. During the same period, Germany and the Netherlands consolidated their positions, while some Central European countries experienced strong growth, in particular Poland, the Czech Republic and Hungary.

An analysis of the competition faced by French exports within the EU shows that Germany remains our main competitor in intra-EU trade. Competition from Italy, Belgium and the United Kingdom is falling off, while competition from the Netherlands and Spain is increasing. Moreover, French exports have been competing with those from Central European countries since those countries' accession to the Single Market, particularly in the automotive sector.

Competition is increasing in France's main long-standing markets, and its export markets have become less diversified than, for example, those of Germany. This is partly the result of a less central location within the EU since the accession of the CEE countries in 2004. The countries bordering France (Germany, Spain, Italy, Belgium and the United Kingdom) account for 70% of its intra-EU exports.

The erosion of France's cost competitiveness in the 2000s and a failure to move production sufficiently upmarket have also been obstacles to the country's exports. Strong cost competitiveness by the CEE countries has led to a re-structuring of value chains in Europe, which some Member States, Germany first and foremost, have been able to take advantage of to maintain their industrial base and boost their exports of finished products.

The significant decline in France's market share of intra-EU exports of goods should be seen in light of the robust performance of exports of services in high value-added sectors (R&D, business and financial services) which are amongst France's largest revealed comparative advantages.