The Impact of Oil Prices on the US Economy

Since the late 2000s, the development of unconventional drilling techniques has greatly increased oil and gas production in the United States. The total net effect of higher oil prices on U.S. activity would remain negative despite the shale revolution. The decline in household purchasing power due to higher fuel prices would only be partly offset by the strong increase in investment in the oil and gas sector.

Since the end of the 2000s, oil and gas production in the United States has increased sharply, thanks to the development of so-called "unconventional" drilling techniques such as the combination of horizontal drilling and hydraulic fracturing (or "fracking").

This rise in production has significantly improved the country's energy trade balance and reduced its energy dependence. The conjoint rise in oil exports and fall in imports have allowed the United States to approach equilibrium on the oil trade balance and to secure a larger share of the global oil and gas market.

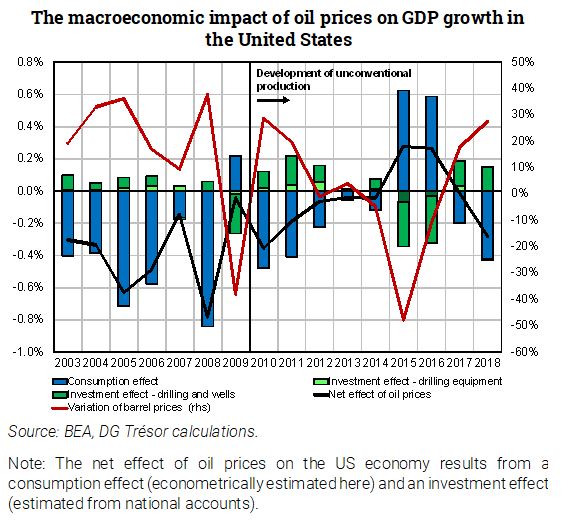

Increases in oil prices have a marked negative impact on activity in oil net-importer countries. Until 2010, the US economy suffered from the rise in crude prices, as it weighed on household purchasing power and pushed up the price of intermediate consumption for firms. Since 2010 and the strong growth in domestic oil production, the impact of oil prices on the US economy has been less clear-cut. Increases now have a very positive impact on the level of investment in the hydrocarbon sector, which counters the negative effect observed on consumption.

Nowadays, the total net effect of a rise in oil prices on US activity may remain negative despite the shale oil revolution. A decrease in household purchasing power brought about by a rise in fuel prices might not be more than partly offset by the strong growth in investment in the oil and gas sector (see Graph).