Trésor-Economics No. 252 - Use of macroeconomic modelling in public policy evaluation

Macroeconomic models are used to forecast spontaneous economic developments or to assess the effects of a reform on variables such as employment or GDP. The Mésange model, co-developed by the DG Treasury and INSEE, is used to assess ex ante the macroeconomic effect of reforms and thus assist in the development of public policies. This type of model is based on theoretical assumptions and empirical estimates, and their results must therefore be interpreted with care.

Macroeconomic models provide quantitative estimates of relationships between macroeconomic variables such as employment, gross domestic product (GDP) and inflation. They are used for forecasting (to project the spontaneous evolution of a country's economy in the short to medium term) or for assessing changes to public policies (to assess the macroeconomic effects of a policy reform prior to actual implementation).

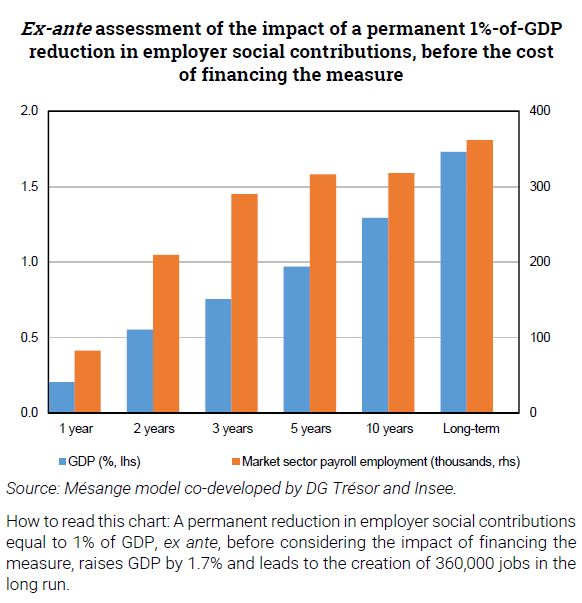

The Mésange model co-developed by DG Trésor (Directorate General of the Treasury) and Insee (National Institute of Statistics and Economic Studies) is used for ex-ante assessment of the macroeconomic impact of policy reforms. The results of the model – whose source code is publicly available – help to inform public policy development and contribute to democratic debate.

Using a single model to assess different measures ensures comparability of the estimated effects of those reforms. The complexity of the assessment methodology depends on the type of reform investigated, and often requires supplementing the model by estimates from the economic literature or specific modules aimed at addressing the measure being assessed.

The effects estimated by the model must then be interpreted by the user. The macroeconomic effects of reforms must be understood as being the difference between the future situation with the reform and the future situation without that reform, and not as the difference between the future situation with the reform and the current state. The time horizon for the impact of the reform, and whether or not the assessment includes the impact of financing the measure, must also be specified when the results are interpreted.

Macroeconomic models rely on theoretical assumptions and on econometric estimation of their equations. Results accordingly reflect past behaviour patterns and they are surrounded by uncertainties. Periodic re-estimation of the models is a way to ensure that the equations capture recent changes in the economy, and to update the model to meet the latest requirements for assessing proposed reforms.