Trésor-Economics No. 243 - World economic outlook in autumn 2019: slowdown and uncertainty

After falling to 3.6% in 2018, global growth is projected to decline sharply in 2019 to 3.1%, before posting a slight upturn in 2020 to 3.3%, driven by stronger activity in many emerging countries. In the major advanced countries, growth is expected to weaken, in the wake of the United States reporting slowing momentum. The risks have increased around this scenario: worsening protectionism, higher likelihood of a no-deal Brexit, and uncertainties about the direction of macroeconomic policies.

After falling to 3.6% in 2018, global growth is projected to decline sharply in 2019 to 3.1%, before posting a slight upturn in 2020 to 3.3%, driven by stronger activity in many emerging countries. In the major advanced countries, growth is expected to weaken, in the wake of the United States reporting slowing momentum.

In the US, activity is set to remain strong in 2019 on the back of fiscal stimulus, but a slowdown is expected in 2020 as the budgetary impulse fades away and the labour market tightens. Meanwhile, protectionist measures are expected to continue to weigh on activity. In the UK, growth is likely to remain moderate in 2019 and 2020 on account of the uncertainty surrounding Brexit and its repercussions, based on the conventional assumption that the UK will leave the EU with a deal on 31 October 2019. In Japan, growth in 2019 is expected to be buoyed by strong domestic demand, despite trade being undermined by China's slowdown and the downturn in the semiconductor cycle. Growth looks set to decline in 2020, however, due to the forthcoming increase in the consumption tax rate.

In the euro area, growth is expected to contract sharply over the forecast period against a similar backdrop to 2018 shaped by the international environment and weakening confidence. Domestic demand is expected to be sustained by resilient consumption, however. In the major countries of the euro area, activity is forecast to pick up slightly in 2020 in Germany and Italy, following a very poor year in 2019. Growth is likely to remain robust in Spain but is expected to slow gradually.

A slowdown in activity is projected to gather pace in China on the back of deleveraging efforts and trade tensions. Growth is expected to remain disappointing in Brazil, India and Russia in 2019, but is likely to improve in 2020 thanks to stimulus measures in 2019. In Turkey, the economy is forecast to contract in 2019, as the after-effects of the 2018 currency crisis are felt. Turkish growth will recover in 2020.

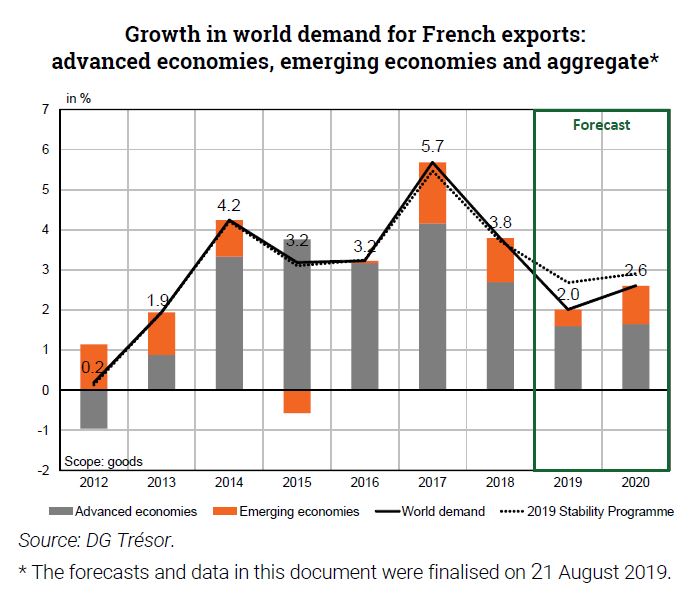

After experiencing two years of strong growth, global trade is projected to slow notably in 2019 before picking up in 2020 (world trade is forecast to increase by 1.8% in 2019 and 2.8% in 2020 after expanding by 4.5% in 2018 – under a working assumption that protectionist measures will not be escalated further). Global trade is expected to bear the brunt of the global slowdown, protectionism and the downturn in the semiconductor cycle. In 2020, it is projected that global trade will be lifted by the recovery in Asian and Turkish trade. Growth in world demand for French exports is projected to follow the same trend over the forecast period.

Uncertainty surrounding this scenario has heightened in recent months, due to the rise of protectionist tensions, the threat of a no-deal Brexit and economic policy uncertainty (in Italy and the United States).